Online share trading platforms have seen an explosion in popularity in recent years as more and more people try to trade in the stock market. It might be difficult to choose the ideal platform for you when there are so many possibilities available, especially if you have a limited budget.

To help you navigate the market, we’ve compiled a list of the top 15 cheapest share trading platforms in the USA, along with their associated charges.

1. Robinhood

Robin Hood is a popular share trading platform that offers commission-free trading of stocks, ETFs, options and crypto currencies. While it may not offer as many advanced features as some other platforms, Robin Hood is a great option for beginners who want to get started with trading without breaking the bank.

Pros:

- Commission-free trading

- User-friendly interface

- Fractional shares

- Mobile app

- Cryptocurrency trading

Cons:

- Limited investment options

- No retirement accounts

- Basic research tools

- Order execution issues in the past

- Customer support issues

2. Webull

Webull is another commission-free trading platform that offers a range of investment options, including stocks, ETFs, options and crypto currencies. It also offers a range of advanced features, such as real-time market data and research tools.

Pros:

- Commission-free trading

- Advanced trading tools and features

- Extensive research and analysis tools

- Cryptocurrency trading

- Extended hours trading

Cons:

- No fractional shares

- No mutual funds or bonds

- No retirement accounts

- Limited customer support

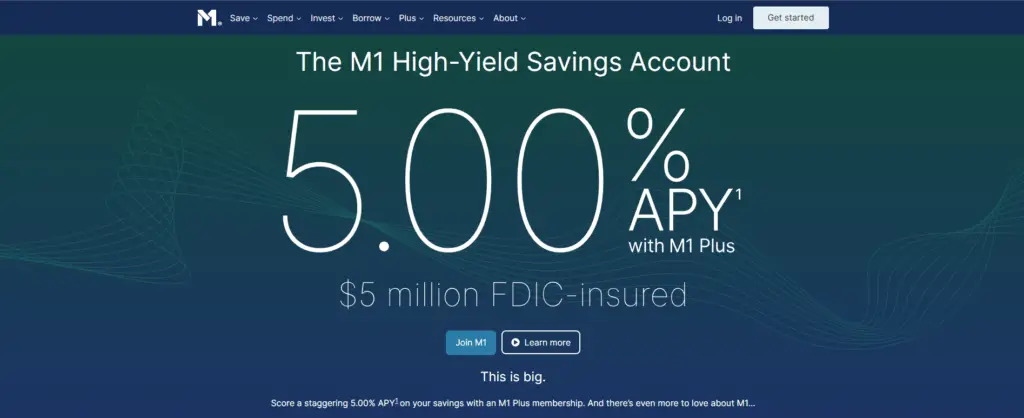

3. M1 Finance

M1 Finance is a robo-advisor platform that allows you to build a custom portfolio of stocks and ETFs. While it does charge fees for certain services, such as borrowing against your investments, M1 Finance is a great option for those who want to automate their investing and avoid high fees.

Pros:

- Fractional shares

- Automated investing

- No commission fees

- Customizable portfolios

- Retirement accounts

Cons:

- Limited investment options

- Limited customer support

- No cryptocurrency trading

4. SoFi Invest

SoFi Invest is a low-cost investment platform that offers commission-free trading of stocks, ETFs and cryptocurrencies. It also offers a range of other financial products, such as loans, insurance and banking services.

Pros:

- No commission fees

- Automated investing

- Fractional shares

- Access to other SoFi products

- Cryptocurrency trading

Cons:

- Limited investment options

- No advanced trading tools

- Limited customer support

5. TD Ameritrade

Popular trading site TD Ameritrade provides a variety of investing alternatives, including stocks, ETFs, options and futures. While it does charge fees for certain services, such as broker-assisted trades, TD Ameritrade is still a great option for those who want access to advanced trading tools and research.

Pros:

- Extensive research tools and analysis

- Multiple trading platforms

- Commission-free trading

- Retirement accounts

- No account minimums

Cons:

- Limited fractional shares

- No cryptocurrency trading

- No automated investing

- Higher fees for options trading

- Limited customer support

6. E*TRADE

E*TRADE is another popular trading platform that offers a range of investment options, including stocks, ETFs, options and futures. It also offers a range of advanced features, such as real-time market data and research tools.

Pros:

- Extensive research tools and analysis

- Multiple trading platforms

- Commission-free trading

- Retirement accounts

- No account minimums

Cons:

- Limited fractional shares

- Higher fees for options trading

- No cryptocurrency trading

- Limited customer support

7. Charles Schwab

Charles Schwab is a well-known investment platform that offers a wide range of investment options, including stocks, ETFs, options and futures. While it does charge fees for certain services, such as broker-assisted trades, Charles Schwab is still a great option for those who want access to advanced trading tools and research.

Pros:

- Commission-free trading

- Extensive research tools and analysis

- Multiple trading platforms

- Retirement accounts

- No account minimums

Cons:

- Limited fractional shares

- Higher fees for options trading

- No cryptocurrency trading

- Limited customer support

8. Fidelity

Stocks, ETFs, options, and futures are just a few of the many investing alternatives available through Fidelity, a well-known trading platform. While it does charge fees for certain services, such as broker-assisted trades, Fidelity is still a great option for those who want access to advanced trading tools and research.

Pros:

- Commission-free trading

- Extensive research tools and analysis

- Multiple trading platforms

- Retirement accounts

- No account minimums

Cons:

- Limited fractional shares

- Higher fees for options trading

- No cryptocurrency trading

- Limited customer support

9. Ally Invest

Ally Invest is a low-cost investment platform that offers commission-free trading of stocks, ETFs and options. It also offers a range of other financial products, such as loans, insurance and banking services.

Pros:

- Commission-free trading

- No account minimums

- Retirement accounts

- Options trading

- Extensive research tools and analysis

Cons:

- Limited fractional shares

- No cryptocurrency trading

- Limited customer support

- No automated investing

10. Vanguard

Vanguard is a well-known investment platform that offers a wide range of investment options, including stocks, ETFs and mutual funds. While it does charge fees for certain services, such as broker-assisted trades, Vanguard is still a great option for those who want access to a range of low-cost index funds.

Pros:

- Low fees

- Extensive research tools and analysis

- Retirement accounts

- No account minimums

- No commission fees for Vanguard ETFs

Cons:

- Limited investment options

- No fractional shares

- No cryptocurrency trading

- Limited customer support

11. TradeStation

TradeStation is a low-cost trading platform that offers a range of investment options, including stocks, ETFs, options and futures. While it does charge fees for certain services, such as broker-assisted trades, TradeStation is still a great option for those who want access to advanced trading tools and research.

Pros:

- Advanced trading tools and features

- Commission-free trading

- Fractional shares

- Retirement accounts

- No account minimums

Cons:

- Higher fees for some trades

- Limited customer support

- No cryptocurrency trading

12. Firstrade

Firstrade is a low-cost investment platform that offers commission-free trading of stocks, ETFs, options and mutual funds. It also offers a range of advanced features, such as real-time market data and research tools, making it a great option for both novice and experienced investors.

Pros:

- Commission-free trading

- Retirement accounts

- No account minimums

- Fractional shares

- Basic research tools

Cons:

- No cryptocurrency trading

- Limited investment options

- Limited customer support

13. Schwab Intelligent Portfolios

Schwab Intelligent Portfolios is a robo-advisor platform that uses algorithms to create and manage a custom portfolio of ETFs. While it does charge fees for certain services, such as account management, Schwab Intelligent Portfolios is a great option for those who want to automate their investing and avoid high fees.

Pros:

- Automated investing

- No account minimums

- Retirement accounts

- No commission fees

- Extensive research tools and analysis

Cons:

- Limited investment options

- No cryptocurrency trading

- Higher fees for some funds

- Limited customer support

14. Betterment

Betterment is another robo-advisor platform that allows you to build a custom portfolio of ETFs. While it does charge fees for certain services, such as account management, Betterment is a great option for those who want to automate their investing and avoid high fees.

Pros:

- Automated investing

- Fractional shares

- Tax loss harvesting

- No account minimums

- Customized portfolio recommendations

Cons:

- Higher fees compared to some competitors

- Limited investment options outside of ETFs

- No direct indexing available

- No real-time trading or individual stock picking

- No margin trading

15. Acorns

Acorns is a unique investment platform that allows you to invest your spare change by rounding up your purchases to the nearest dollar and investing the difference in a custom portfolio of ETFs. While it does charge fees for certain services, such as account management, Acorns is a great option for those who want to start investing with small amounts of money.

Pros:

- Easy to use, especially for beginner investors

- Automated investing with round-ups

- No account minimums

- Offers a checking account with no fees

Cons:

- Higher fees compared to some competitors

- Limited investment options outside of ETFs

- No tax loss harvesting

- No direct indexing available

- Limited customization options

- No real-time trading or individual stock picking

- No margin trading

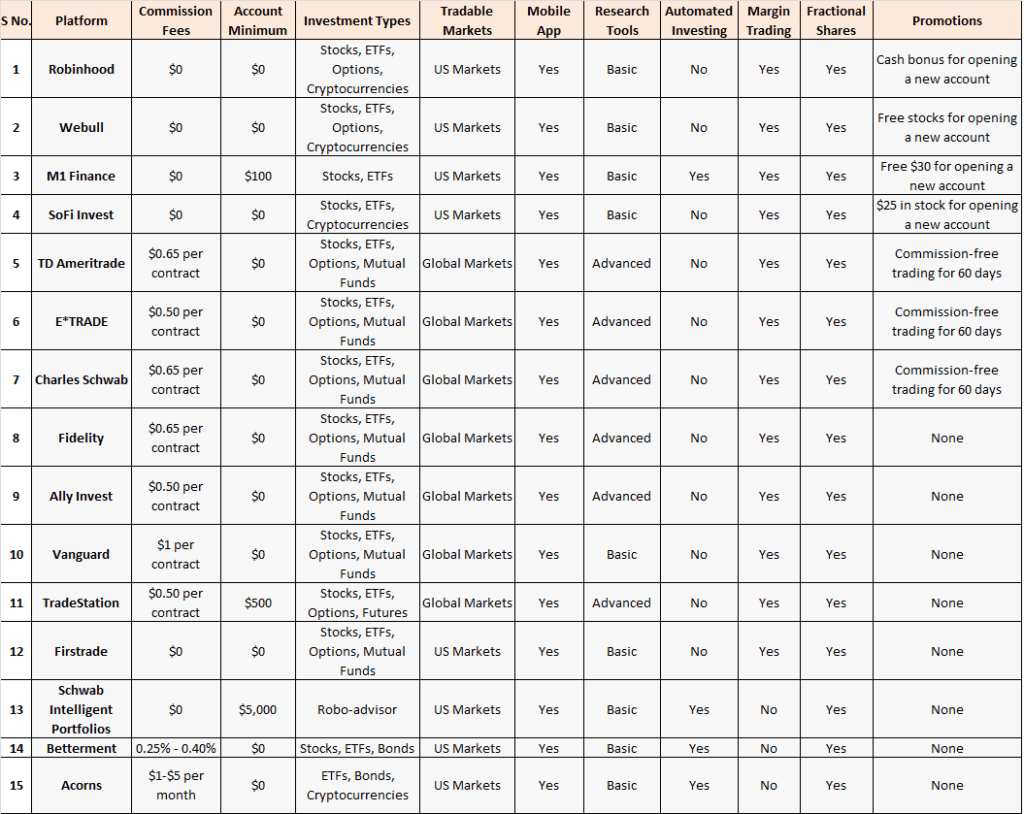

Here’s a comparison table of the features and fees of 15 popular investment platforms in the USA:

Conclusion

there are many affordable share trading platforms available in the USA, each with their own unique features and associated charges. Whether you’re a beginner looking to get started with investing or an experienced trader looking for advanced tools and research, there’s a platform out there that will suit your needs and budget. Be sure to do your research and compare different platforms before making a decision.

-

39-year-old makes about $18,000 a month in passive income without a college degree: ‘I work only 4 hours a day’

After dropping out of college in 2007, Amy Landino started a side hustle creating videos and doing social media. Ultimately she was able to quit her day job.

-

33-year-old mortician doesn’t fear death and is ‘wildly happy’ earning $87,000 a year: I haven’t ‘gone home sad a single day’

The first time Victor M. Sweeney observed an embalming, it was for an 18-year-old woman who had died in a car crash just before her high school graduation. At the …

-

All sides claim victory in Georgia election as exit polls give different results

Supporters of the Georgian Dream party celebrate at the party’s headquarters after the announcement of exit poll results in parliamentary elections, in Tbilisi, Georgia October 26, 2024.. Irakli Gedenidze | …

-

Biden says Elon Musk was an ‘illegal worker’ when he began U.S. career

Joe Biden, left, and Elon Musk. Evelyn Hockstein | Reuters; Andrew Harrer | Bloomberg | Getty Images. President Joe Biden called out Tesla and SpaceX CEO Elon Musk, now a …

-

39-year-old makes about $18,000 a month in passive income without a college degree: ‘I work only 4 hours a day’

After dropping out of college in 2007, Amy Landino started a side hustle creating videos and doing social media. Ultimately she was able to quit her day job.

-

39-year-old makes about $18,000 a month in passive income without a college degree: ‘I work only 4 hours a day’

After dropping out of college in 2007, Amy Landino started a side hustle creating videos and doing social media. Ultimately she was able to quit her day job.

One Comment on “Affordable Trading: Our Guide to the Top 15 Cheapest Share Trading Platforms”