ETRADE is an online brokerage platform that was acquired by Morgan Stanley in 2020. The platform offers a variety of investment and trading services including stocks, options, mutual funds and ETFs. With its advanced trading tools and comprehensive research resources, ETRADE is a popular choice among active traders and long-term investors alike.

We will also explore how ETRADE compares to other online brokers in the industry and provide a final verdict on whether it is a good choice for your investment needs.

Trading Platform

ETRADE’s trading platform is one of its standout features offering a comprehensive suite of tools and features that cater to both beginner and advanced traders. The platform is available as a desktop application and also in mobile app allowing traders to access their accounts and manage their portfolios from anywhere.

The platform’s user interface is easy and simple to use and it includes an editable dashboard that enables users to set up watch lists and track their investments in real-time. ETRADE’s platform also offers advanced charting tools, with over 100 technical indicators and drawing tools to help traders analyze market trends and make informed trading decisions.

ETRADE’s platform also features a range of order types, including market orders, limit orders, stop-loss orders, and trailing stop orders. Traders can also set up conditional orders and alerts to trigger trades based on specific market conditions.

Overall, ETRADE’s trading platform is a robust and reliable tool for traders of all levels, providing a range of features and tools to help investors make informed trading decisions.

Account Types

ETRADE offers several account types to cater to different investment goals and needs. These include:

Individual Brokerage Account: This is a standard brokerage account that allows investors to buy and sell stocks, bonds, mutual funds and other securities.

Retirement Accounts: ETRADE offers several retirement accounts, including Traditional IRA, Roth IRA and SEP IRA accounts. These accounts allow investors to save for retirement with tax advantages.

Custodial Account: This is an account that allows parents or other adults to invest on behalf of a minor.

Managed Accounts : ETRADE offers a range of managed account options, including robo-advisory services and professionally managed accounts. These accounts are designed to provide investors with an independent perspective to investing with portfolios managed by experts.

Overall, ETRADE offers a range of account types to cater to different investment needs and goals, providing investors with a flexible and customizable investment platform.

*Image ETRADE.com

Fees

ETRADE’s fee structure is competitive with other online brokers in the industry. Here are some of the key fees to be aware of:

- Stock and ETF Trades: ETRADE charges $0 for stock and ETF trades.

- Options Trades : ETRADE charges $0.65 per contract for options trades.

- Mutual Funds: ETRADE offers over 4,400 no-load, no-transaction-fee mutual funds. However, investors will pay a $19.99 fee for any mutual fund trades that are not part of the no-transaction-fee program.

- Account Fees: ETRADE does not charge any annual account fees or inactivity fees.

Overall, ETRADE’s fee structure is competitive with other online brokers in the industry, with no account fees or inactivity fees and low trading fees for stocks, ETFs and options.

Customer Support

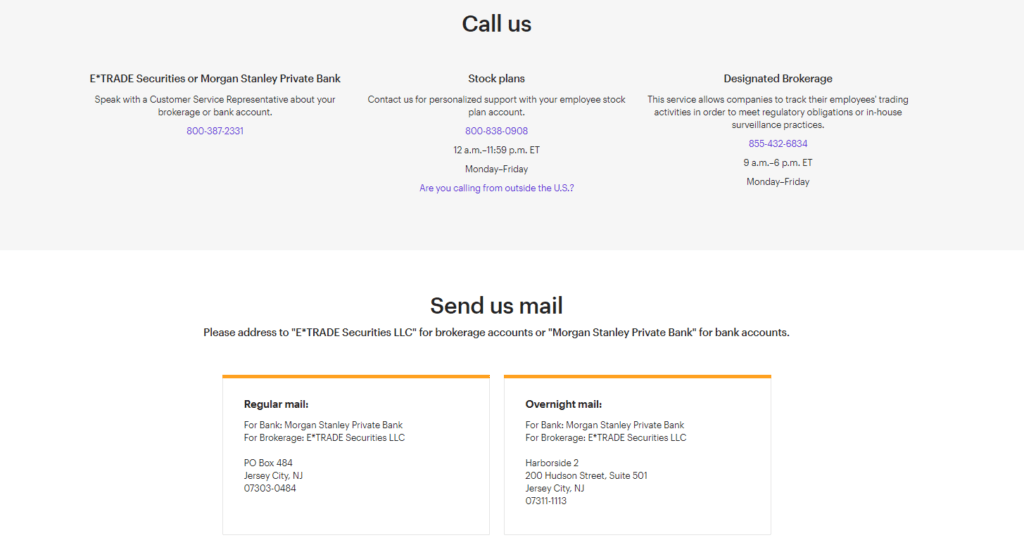

*Image ETRADE.com

ETRADE offers a range of customer support options to help investors manage their accounts and navigate the platform. The platform offers phone support, email support and a live chat feature that allows investors to connect with a customer support representative in real-time.

ETRADE’s website also features a comprehensive Help Centre, with articles and tutorials

Covering a range of topics, including account management, trading tools, and investment strategies. The Help Centre is easy to navigate and provides helpful resources for both novice and experienced investors.

Additionally, ETRADE offers a community forum where investors can connect with other traders and share information and insights about the markets. The forum is moderated by ETRADE’s support team and is a helpful resource for investors looking to connect with like-minded individuals.

Overall, ETRADE’s customer support options are robust and provide investors with multiple channels to get help and support as needed.

Here are some advantages and disadvantages of ETRADE:

Advantages:

- Commission-free stock, ETF, and options trades

- Wide variety of investment options, including mutual funds, bonds, and futures

- Robust trading platform with advanced charting tools and customizable layouts

- Comprehensive educational resources for beginner investors

- Mobile app with features for on-the-go trading and account management

- Strong customer support options, including 24/7 phone and chat support

- Community forum for connecting with other investors and trading experts

- No account or inactivity fees

- Cash management account with high-interest savings and checking options

- Integration with Morgan Stanley for access to wealth management services

Disadvantages:

- Higher mutual fund trading fees compared to some other online brokers

- Limited options for fractional share investing

- No robo-advisory service for automated investment management

- No direct mutual fund or bond trading

- Limited access to IPOs and new issues

- High margin interest rates compared to some other online brokers

- Limited international investing options

- Limited availability of physical branch locations for in-person support

- Options trading fees are higher compared to some other online brokers

- Minimum account balance required for some investment options

Comparison to Other Online Brokers

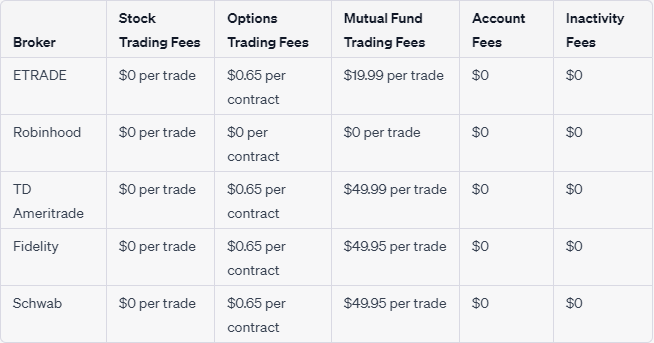

Here is a table comparing ETRADE’s fees with those of some other popular online brokers:

ETRADE’s fees are generally competitive with those of other popular online brokers, with low fees for stock and options trades and no account or inactivity fees. However, ETRADE’s mutual fund trading fees are higher than those of some other brokers, which may be a consideration for investors who primarily invest in mutual funds.

When comparing ETRADE to other online brokers in the industry, it is clear that ETRADE has several standout features that make it a competitive choice for investors. Its trading platform is robust and customizable, offering a range of advanced tools and features that cater to both novice and experienced traders.

In terms of fees, ETRADE’s fee structure is competitive with other online brokers, with low trading fees for stocks, ETFs and options and no account or inactivity fees. Additionally, ETRADE’s range of account types and investment options make it a flexible and customizable platform for investors looking to meet their investment goals.

However, there are some areas where ETRADE may fall short compared to other online brokers. For example, while ETRADE offers over 4,400 no-load, no-transaction-fee mutual funds, investors will pay a fee for any mutual fund trades that are not part of the no-transaction-fee program. This may be a disadvantage for investors who primarily invest in mutual funds.

Another area where ETRADE may fall short is in its educational resources. While ETRADE does offer a comprehensive Help Centre and a community forum, some investors may find that the educational resources offered by other online brokers, such as webinars and courses, are more robust and helpful.

Final Verdict

Overall, ETRADE is a robust and reliable online broker that offers a range of features and tools to help investors manage their portfolios and make informed investment decisions. Its trading platform is one of the standout features, providing a comprehensive suite of tools and features that cater to both beginner and advanced traders.

ETRADE’s fee structure is competitive with other online brokers in the industry, with low trading fees for stocks, ETFs and options and no account or inactivity fees. Additionally, ETRADE’s range of account types and investment options make it a flexible and customizable platform for investors looking to meet their investment goals.

While there are some areas where ETRADE may fall short compared to other online brokers, such as in its educational resources and mutual fund fees, these drawbacks are relatively minor compared to the platform’s overall strengths.

Conclusion :

ETRADE is a solid choice for investors looking for a comprehensive and customizable online brokerage platform. Its robust trading platform, competitive fee structure and range of account types make it a strong contender in the online brokerage industry.