Are you seeking for a credible savings account to enable you to accomplish your financial objectives? Look no further than CIT Bank’s Savings Connect account! With competitive interest rates and flexible terms, this account is the perfect solution for anyone who wants to save money and earn interest at the same time.

What is CIT Bank Savings Connect?

CIT Bank Savings Connect is an online savings account that offers competitive interest rates and flexible terms. It is a high-yield savings account that allows you to earn interest on your savings while keeping your funds easily accessible. CIT Bank is a member of the FDIC, which means your deposits are insured up to $250,000.

How does CIT Bank Savings Connect work?

CIT Bank Savings Connect works by combining a Savings account with an eChecking account. The Savings account earns a high interest rate, while the eChecking account allows you to access your funds quickly and easily. To earn the highest interest rate, you must meet certain requirements each month, such as making a qualifying deposit into your eChecking account.

The interest rate for CIT Bank Savings Connect varies depending on the balance and whether you meet certain requirements each month. The account offers a tiered interest rate structure, which means that the interest rate you earn will increase as your balance grows.

As of May 2023, the interest rate for balances under $25,000 is 0.50% APY, while balances of $25,000 or more earn a higher interest rate of 0.55% APY. However, in order to earn the higher interest rate on balances of $25,000 or more, you must also have a linked eChecking account with a qualifying monthly direct deposit of at least $200.

It’s important to note that interest rates can change over time and are subject to market conditions. CIT Bank may adjust the interest rates on Savings Connect accounts at any time. To see the most up-to-date interest rates for CIT Bank Savings Connect, you can visit the CIT Bank website or contact their customer service team.

What are the benefits of CIT Bank Savings Connect?

One of the biggest benefits of CIT Bank Savings Connect is its competitive interest rates. The account also has no monthly fees and no minimum balance requirements. Plus, you can access your funds easily and quickly with the eChecking account. CIT Bank Savings Connect also offers a mobile app, which makes managing your account simple and convenient.

CIT Bank Savings Connect offers several benefits that make it a popular choice for savers. Here are some of the key benefits:

- Competitive interest rates: CIT Bank Savings Connect offers competitive interest rates that are higher than the national average for savings accounts. This means that your money will earn more interest and help you reach your savings goals faster.

- No monthly fees or minimum balance requirements: Unlike many other banks, CIT Bank does not charge any monthly fees for the Savings Connect account, nor does it require you to maintain a minimum balance. This means you can save as much or as little as you want without worrying about extra charges.

- Easy access to your funds: With Savings Connect, you can easily transfer money to and from your other accounts, and there are no limits on the number of transfers you can make. You can also use your Savings Connect account to pay bills or make purchases with a CIT Bank debit card.

- FDIC-insured: CIT Bank is a member of the Federal Deposit Insurance Corporation (FDIC), which means your deposits are insured up to $250,000 per account. This provides peace of mind and protection for your hard-earned savings.

- Simple and convenient: The account can be opened and managed online, and CIT Bank’s mobile app allows you to check your balance, transfer funds, and deposit checks from anywhere.

Overall, CIT Bank Savings Connect offers a straightforward and convenient way to save money, with competitive interest rates and no fees or minimum balance requirements.

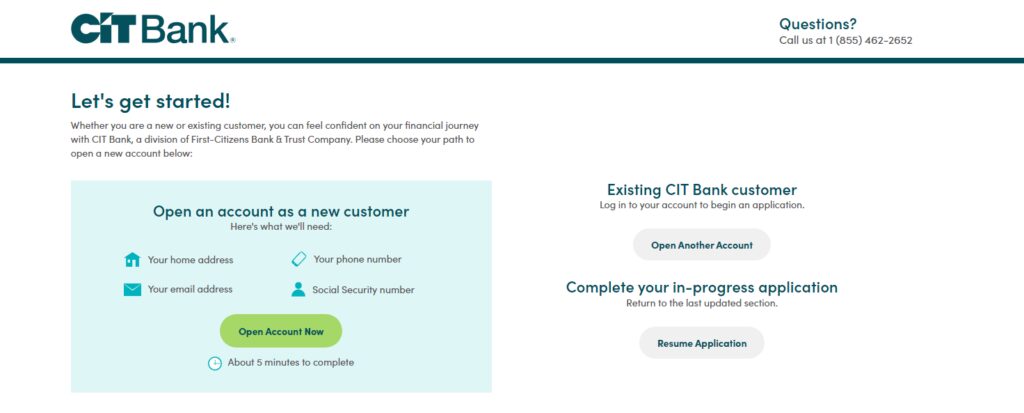

How to open a CIT Bank Savings Connect account?

Opening a CIT Bank Savings Connect account is simple and can be done entirely online. To get started, visit the CIT Bank website and click on the “Open an Account” button. You will need to provide some personal information, such as your name, address, and Social Security number. Once your account is open, you can start making deposits and earning interest right away.

How to deposit and withdraw money from CIT Bank Savings Connect?

Depositing money into your CIT Bank Savings Connect account is easy. You can transfer funds from another bank account, set up direct deposit, or use mobile deposit through the mobile app. Withdrawing money is just as simple. You can transfer funds to another bank account, use the eChecking account, or request a check to be mailed to you.

How to manage your CIT Bank Savings Connect account?

Managing your CIT Bank Savings Connect account is easy with the mobile app. You can check your account balance, view transaction history, and make deposits or withdrawals. You can also set up automatic transfers to help you save money each month.

What are the fees and minimum balance requirements for CIT Bank Savings Connect?

CIT Bank Savings Connect has no monthly fees and no minimum balance requirements. However, to earn the highest interest rate, you must meet certain requirements each month, such as making a qualifying deposit into your eChecking account.

How does CIT Bank Savings Connect compare to other savings accounts?

CIT Bank Savings Connect is a highly competitive savings account, offering interest rates that are often higher than those of traditional banks. It also has no monthly fees or minimum balance requirements, making it an excellent option for anyone who wants to save money without worrying about extra charges.

Compared to other online savings accounts, CIT Bank Savings Connect holds its own. It offers competitive interest rates and flexible terms, and it’s easy to manage with the mobile app. Plus, the eChecking account allows you to access your funds quickly and easily.

Frequently Asked Questions (FAQs)

- Is CIT Bank Savings Connect FDIC-insured?

- Yes, CIT Bank is a member of the FDIC, which means your deposits are insured up to $250,000.

- What is the interest rate for CIT Bank Savings Connect?

- The interest rate for CIT Bank Savings Connect varies depending on the balance and whether you meet certain requirements each month. You can check the current rates on the CIT Bank website.

- Is there a minimum balance requirement for CIT Bank Savings Connect?

- No, there is no minimum balance requirement for CIT Bank Savings Connect.

- Can I withdraw money from my CIT Bank Savings Connect account at any time?

- Yes, you can withdraw money from your CIT Bank Savings Connect account at any time.

- Can I set up automatic transfers to my CIT Bank Savings Connect account?

- Yes, you can set up automatic transfers to your CIT Bank Savings Connect account to help you save money each month

Conclusion

CIT Bank Savings Connect is an excellent option for anyone who wants to save money and earn interest at the same time. With its competitive interest rates, flexible terms, and no monthly fees or minimum balance requirements, it’s easy to see why this account is so popular. Plus, the mobile app makes managing your account simple and convenient. So why wait? Open a CIT Bank Savings Connect account today and start reaching your financial goals!