Are you searching to discover a quick, dependable and secure way to send money to friends or your relatives? If so, then you might want to consider using CIT Bank Zelle. People are searching for more practical ways to send money to their loved ones in the growing popularity of digital payments. CIT Bank Zelle is a peer-to-peer (P2P) payment service that allows users to send and receive money quickly and securely.

What is CIT Bank Zelle?

CIT Bank Zelle is a P2P payment service that allows users to send and receive money quickly and securely. It is collaboration between CIT Bank and Zelle, an American digital payments network with over 100 million members. With CIT Bank Zelle, users can send money to friends and family members who have enrolled in the Zelle network.

How does CIT Bank Zelle work?

Enrolling in Zelle

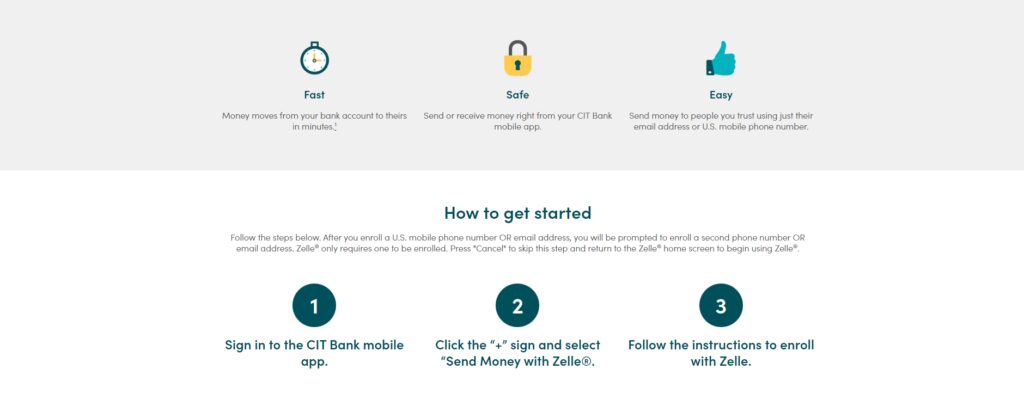

To use CIT Bank Zelle, you need to enrol in the Zelle network. You can enrol through the CIT Bank mobile app or website. Once you have enrolled, you can send and receive money from anyone who has also enrolled in the Zelle network.

Sending money with Zelle

To send money with CIT Bank Zelle, you need to follow these steps:

- Log in to your CIT Bank mobile app or website.

- Select the account you want to use for the transfer.

- Click on the “Send Money” tab.

- Enter the recipient’s email address or phone number.

- Enter the amount you want to send.

- Confirm the details and click on “Send”.

Receiving money with Zelle

To receive money with CIT Bank Zelle, you need to follow these steps:

1. You will receive an email or text message notifying you that someone has sent you money through Zelle.

2. Click on the link in the message to accept the transfer.

3. If you are not enrolled in Zelle, you will be prompted to enrol to receive the transfer.

4. Benefits of using CIT Bank Zelle

Speed

With CIT Bank Zelle, you can send and receive money instantly, which makes it a great option for emergencies or last-minute expenses. The money will be in your account right away; you don’t have to wait several days.

Security

CIT Bank Zelle uses advanced encryption and authentication technologies to ensure that your transactions are secure. This means that you can relax knowing that scammers won’t have access to your money and personal information.

Convenience

CIT Bank Zelle is very easy to use. You can send and receive money from anywhere at any time. You don’t have to visit bank or ATM to complete the transaction and also you don’t have to worry about carrying cash or checks.

No fees

Unlike some other money transfer services, CIT Bank Zelle does not charge any fees for sending or receiving any money. it is an affordable choice for those who wish to avoid paying transaction costs.

Wide network

CIT Bank Zelle is connected to a wide network of banks and credit unions, which means that you can send money to almost anyone with a bank account in the US. Furthermore, since they don’t need to register for a new service or open a new account only to get the payments, this makes it simpler for consumers to receive money.

Secure

Security is a top priority for CIT Bank Zelle, and they use the latest encryption technology to protect your personal and financial information. They offer fraud protection to help you recover your hard earned money if your account is compromised.

Mobile app

CIT Bank Zelle has a mobile app that you can download for free from the App Store or Google Play. This app makes it easy to send and receive money on the go. You can also view your transaction history and manage your account from your mobile device.

Limits

There are some limits to how much money you can send or receive using CIT Bank Zelle. The daily money sending limit is $2,500 and monthly limit is $10,000. The daily limit for receiving money is $2,000.

Customer service

CIT Bank Zelle has a dedicated customer service team that is available to assist you with any issues or concerns that you have. You can contact them by phone, email or chat and they will do their best to resolve your issue as quickly as possible.

Conclusion

CIT Bank Zelle is a convenient, cost-effective, and secure way to send and receive money online. With its wide network, easy-to-use mobile app and top-notch security features, it’s no wonder that more and more people are turning to CIT Bank Zelle for their money transfer needs.

Frequently Asked Questions

1. How long does it take to transfer money using CIT Bank Zelle?

•Money transferred using CIT Bank Zelle is usually available within minutes.

2. Are there any fees for using CIT Bank Zelle?

•No, CIT Bank Zelle does not charge any fees for sending or receiving money.

3. What is the daily limit for sending money using CIT Bank Zelle?

•The daily limit for sending money using CIT Bank Zelle is $2,500.

4. Is CIT Bank Zelle secures?

•Yes, CIT Bank Zelle uses the latest encryption technology and offers fraud protection to help protect your personal and financial information.

5. Can I use CIT Bank Zelle to send money to someone outside of the US?

•No, CIT Bank Zelle is only available for sending money within the US.