Students and their families are forced to take out student loans to pay for their education due to the expense for higher education keeps rising. Education loans have enabled millions of students to complete their studies and achieve their dreams. However, because of their high interest rates and rigid repayment schedules, student loan debt may quickly accumulate for many borrowers.

Fortunately, education loan refinancing offers a solution to those who struggle with high-interest rates or unmanageable repayment options.

Introduction

Education loans are a significant investment in one’s future. However, high-interest rates and inflexible repayment terms can create financial stress for borrowers. Education loan refinancing offers an opportunity to manage student debt and improve financial stability.

This article will provide a comprehensive guide to education loan refinancing, including its definition, benefits and drawbacks, eligibility requirements, and tips for choosing a lender.

What is Education Loan Refinancing?

Education loan refinancing is the process of obtaining a new loan with a private lender to replace one or more existing education loans. It will be simpler for borrowers to manage their student debt with the new loan because it normally has a lower interest rate and better repayment conditions.

How Does Education Loan Refinancing Work?

Education loan refinancing works by paying off one or more existing loans with a new loan from a private lender. The new loan often provides better terms for repayment, such as a lower monthly payment or a longer payback period and a lower interest rate.

Borrowers have option to refinance one or more loans, depending on their needs. Private lenders may offer both fixed and Floating interest rates and borrowers may be able to choose their repayment term.

Benefits of Education Loan Refinancing

Lower Interest Rates

Lower interest rates might be one of the main advantages of refinancing student loans. Private lenders generally offers lower interest rates than federal education loans, which can save borrowers thousands of dollars during the period of loan.

Lower Monthly Payments

Refinancing education loans can also lead to lower monthly payments. By extending the repayment term or obtaining a lower interest rate, borrowers can reduce their monthly payment, making it easier to manage their student debt.

Simplified Repayment

Education loan refinancing can simplify repayment by consolidating multiple loans into one loan. This makes it easier to manage payments as borrowers only need to make one payment each month.

Release of Co-Signer

Education loan refinancing can also release a co-signer from the original loan. This can be beneficial for borrowers who have improved their credit since obtaining the original loan or for those who wish to assume full responsibility for their student debt.

Drawbacks of Education Loan Refinancing

While education loan refinancing can offer significant benefits, there are also some potential drawbacks to consider before making a decision. Here are five potential drawbacks of education loan refinancing:

1. Loss of federal loan benefits – If you refinance your federal education loans with a private lender, you will lose access to federal loan benefits such as income-driven repayment plans, loan forgiveness programs, and deferment or forbearance options.

2. Potential loss of borrower protections – Federal loans offer certain borrower protections, such as loan discharge in the event of death or disability that may not be available with private loans.

3. Potential for higher interest rates – While education loan refinancing can result in lower interest rates and save you money, there is also a risk that you could end up with a higher interest rate than your current loan if you don’t qualify for the best rates.

4. Fees and penalties – Some lenders may charge fees for refinancing your education loans, such as application fees or origination fees. Additionally, some lenders may charge penalties for paying off your loan early or missing payments.

5. Impact on credit score – Refinancing your education loans can result in a hard credit check, which can temporarily lower your credit score. Further, if you are unable to pay the education loan EMI on time, your credit score could be negatively impacted.

It’s important to carefully consider these potential drawbacks and weigh them against the potential benefits of education loan refinancing before making a decision.

Eligibility Requirements for Education Loan Refinancing

To be eligible for education loan refinancing, borrowers typically need to meet certain requirements, such as:

- Having a good credit score (typically 650 or higher)

- Having a steady income

- Being a U.S. citizen or permanent resident

- Having a minimum loan balance (usually around $5,000)

When determining a borrower’s eligibility, lenders also take into consideration factors including job history, debt-to-income ratios, and level of education.

How to Apply for Education Loan Refinancing

To apply for education loan refinancing, borrowers typically need to follow these steps:

1. Research and compare lenders: Borrowers should research and compare multiple lenders to find the best refinancing options for their needs.

2. Gather documentation: Borrowers will need to provide documentation such as pay stubs, tax returns, and loan statements to complete the application process.

3. Submit an application: Borrowers can submit an application online or through a lender’s mobile app.

4. Wait for approval: Lenders will evaluate the application and notify the borrower of their decision.

5. Accept the loan: If approved, borrowers can accept the new loan and use the funds to pay off their existing loans.

Tips for Choosing a Lender for Education Loan Refinancing

When choosing a lender for education loan refinancing, borrowers should consider the following factors:

- Interest rates: Compare interest rates from multiple lenders to find the best rate.

- Repayment terms: Look for lenders that offer flexible repayment terms, such as variable or fixed interest rates and different repayment periods.

- Fees: Check for any origination fees, prepayment penalties, or other fees that may increase the cost of the loan.

- Customer service: Look for lenders with good customer service ratings and positive reviews from other borrowers.

- Reputation: Choose a reputable lender with a track record of successfully refinancing education loans.

There are many companies that offer educational loan refinancing in the USA, each with their own unique features and benefits. Here are five of the top companies:

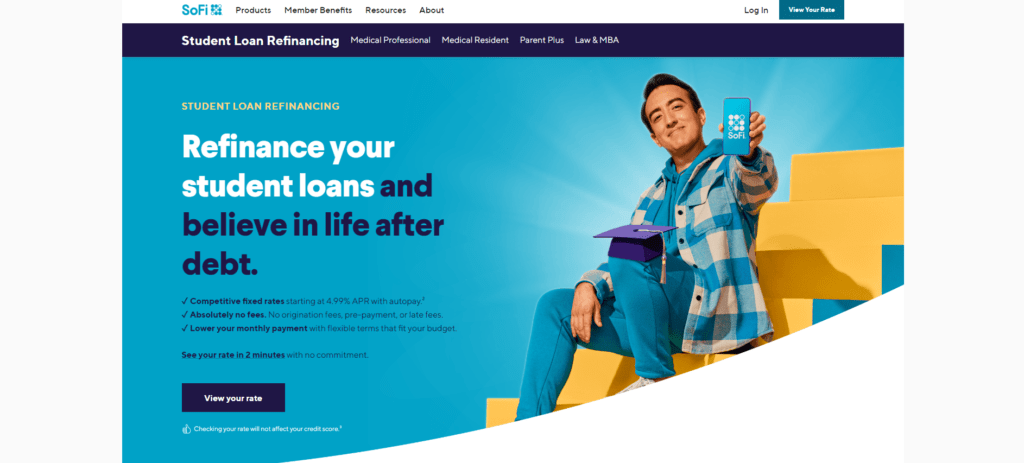

- SoFi – SoFi offers refinancing for both federal and private education loans with no origination fees or prepayment penalties. They also offer unemployment protection, career coaching, and networking events for members.

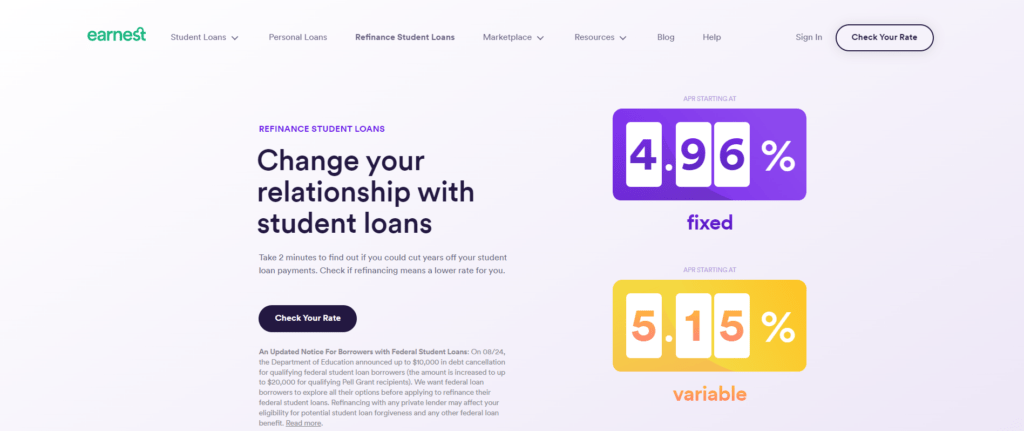

- Earnest – Earnest offers personalized rates and flexible repayment terms, allowing borrowers to customize their loan to fit their financial goals. They also offer an option to skip one payment per year and a “precision pricing” feature that allows borrowers to customize their monthly payment.

- CommonBond – CommonBond offers refinancing for both federal and private education loans with no origination fees or prepayment penalties. They also offer a “hybrid” loan that combines fixed and variable rates, as well as a social promise to fund education for children in need.

- Laurel Road – Laurel Road offers refinancing for both federal and private education loans with no origination fees or prepayment penalties. They also offer personalized rates and a 0.25% rate discount for enrolling in automatic payments.

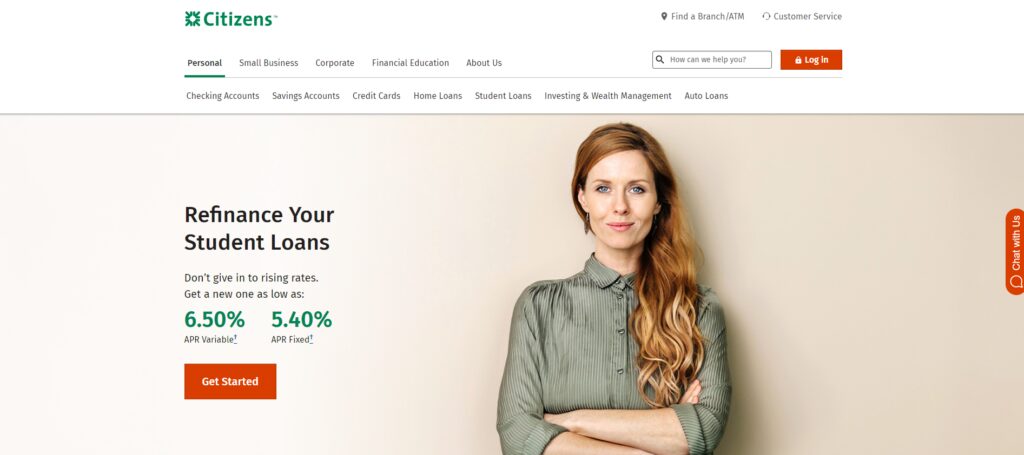

- Citizens Bank Citizens Bank offers refinancing for both federal and private education loans with no origination fees or prepayment penalties. They also offer a multi-year approval option, allowing borrowers to secure their rate for up to five years.

Note : it is important to research and compare different lenders to find the best option for your individual needs and financial situation.

Conclusion

Education loan refinancing can be a smart financial decision for borrowers who are struggling to pay their high-interest rates or unmanageable repayment terms. However, it’s essential to analyze the advantages and disadvantages of refinancing and select a reliable lender with beneficial terms and conditions.

By following the tips mentioned in this article, borrowers can make an appropriate decision about whether education loan refinancing is right for them or not.

Frequently Asked Questions

1. Can I refinance both federal and private education loans?

Yes, many lenders offer the option to refinance both federal and private education loans. However, it’s important to compare the possible savings from refinancing with the potential loss of federal benefits.

2. Will refinancing my education loans affect my credit score?

Refinancing your education loans may temporarily lower your credit score, as lenders will typically perform a hard credit check when evaluating your application. However, over time, on-time payments and a lower debt-to-income ratio can have a positive impact on your credit score.

3. Can I choose my repayment term when refinancing my education loans?

Yes, many lenders offer flexible repayment terms, allowing borrowers to choose from different repayment periods, such as 5, 10, or 15 years. Choosing a longer repayment term can result in lower monthly payments but may also increase the total cost of the loan.

4. Is it possible to refinance my education loans more than once?

Yes, borrowers can refinance their education loans multiple times if they find better refinancing options or if their financial situation changes. However, it’s important to consider any fees or penalties associated with refinancing before making a decision.

5. Are there any alternatives to education loan refinancing?

Yes, there are several alternatives to education loan refinancing, such as income-driven repayment plans, loan forgiveness programs, and deferment or forbearance options for federal loans. It’s necessary that you analyze each option in detail and choose the one that best suits your financial condition and objectives.

One Comment on “How to Save Money on Interest with Education Loan Refinancing”