What is the Discover it Credit Card?

The Discover it Credit Card is a popular credit card that offers cash back rewards and a variety of benefits to cardholders. Discover Financial Services, a leading credit cards issuer and other financial products, introduced the card in the year 2013.

The Discover it Credit Card is a cash back credit card that allows you to earn rewards on your purchases. The Discover it Credit Card has no annual fee, making it an attractive option for those who want to earn rewards without paying for the privilege.

However, there are some fees to be aware of:

- Balance transfer fee: 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms for details)

- Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater

- Late payment fee: Up to $40

- Returned payment fee: Up to $40

*To prevent late fees and preserve a good credit score, it’s important to be aware of these charges and make payments on time.

Features and Benefits of the Discover it Credit Card

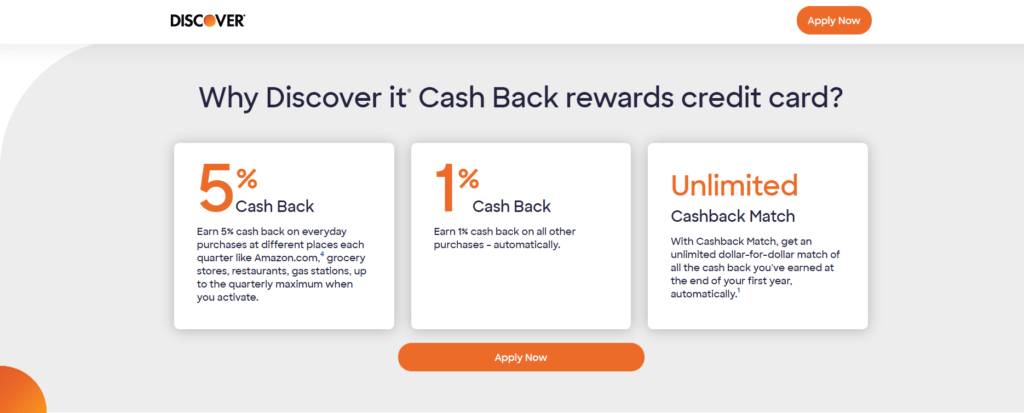

Cash back Rewards Program

The Discover it Credit Card offers a generous cash back rewards program that allows you to earn cash back on your purchases. Card holders earn 5% cash back on up to $1,500 in purchases , rotating bonus categories each quarter, and 1% cash back on all other purchases.

Introductory APR Offer

New cardholders also have the opportunity to take advantage of an introductory APR offer. The Discover it Credit Card offers a 0% introductory APR for the first 14 months on purchases and balance transfers.

No Annual Fee

One of the most attractive features of the Discover it Credit Card is that it has no annual fee. This means that you can earn rewards without paying any annual fee for using the card.

FICO Score Tracking

Another benefit of the Discover it Credit Card is that it provides cardholders with access to their FICO credit score for free. By doing so, you can monitor your credit score and take action in order to improve it over time.

Fraud Protection

Discover offers robust fraud protection to its cardholders. You may get in touch with Discover if you see any illegal charges on your card, and they will look into it and try to fix the problem.

How to apply for the Discover it Credit Card

- If you are interested in applying for the Discover it Credit Card, the application process is very simple and easy. You can apply online by visiting the Discover website and filling online application.

- You must submit certain basic details, such as your name, address and Social Security number, while applying for the card.

- You are also required to provide information about your income and employment status.

- After you’ve submitted your application, Discover will analyze it and inform you of your status. You will get your card in the mail a few business days after being accepted.

Tips for Maximizing Your Rewards

There are a few strategies and ideas you can use to optimize your benefits if you want to make the most of your Discover it Credit Card.

- Bonus Categories

One of the key features of the Discover it Credit Card is the rotating bonus apart from the standard 1% cash back on all purchases, cardholders can earn 5% cash back on up to $1,500 in purchases in different bonus categories that change every quarter. To maximize your rewards, be sure to activate the bonus categories each quarter and make purchases in those categories.

- Cash back Match

Discover offers a unique feature called Cash back Match, where they will match all the cash back earned in the first year of card membership. For example, if you earn $200 in cash back during the first year, Discover will match that amount, giving you a total of $400 in cash back.

- Referral Bonus

Discover also offers a referral bonus program, where you can earn a $50 statement credit for each person you refer who is approved for the card. You can refer up to 10 people per year, for a total of $500 in referral bonuses.

- Shop with Discover

Discover also offers cash back when you shop through their online shopping portal, Shop with Discover. Simply log in to your account and shop at your favourite retailers through the portal to earn additional cash back on your purchases.

Common Questions and Concerns about the Discover it Credit Card

1. What is the minimum credit score required to apply for the Discover it Credit Card?

Discover does not disclose the minimum credit score required to apply for the card. However, it is recommended that you have a good to excellent credit score to increase your chances of approval.

2. Does the Discover it Credit Card have a foreign transaction fee?

No, the Discover it Credit Card does not charge foreign transaction fees.

3. How do I redeem my cash back rewards?

You can redeem your cash back rewards for statement credits, direct deposit to your bank account or as a payment to your Discover card balance. You can also use your rewards to make purchases at select retailers.

4. What happens if I miss a payment?

If you miss a payment on your Discover it Credit Card, you may be subject to late fees and a penalty APR. It is important to make payments on time to avoid these fees and maintain a good credit score.

5. Is the Discover it Credit Card a good option for balance transfers?

Yes, the Discover it Credit Card offers a 0% introductory APR on balance transfers for the first 14 months. This can be a great option if you have high-interest credit card debt that you want to consolidate and pay off.

Conclusion

The Discover it Credit Card is a great option for those looking to earn cash back rewards and take advantage of a variety of benefits without paying an annual fee. With a generous cash back rewards program, no foreign transaction fees, and access to your FICO credit score for free, the Discover it Credit Card is a great choice for anyone looking for a reliable and rewarding credit card.

Frequently Asked Questions

1. Is the Discover it Credit Card a good option for travel rewards?

No, the Discover it Credit Card does not offer travel rewards. Consider using a different credit card if you’re searching for one that rewards travel.

2. Can I use my Discover it Credit Card outside of the United States?

Yes, you can use your Discover it Credit Card outside of the United States. However, be aware that some merchants may not accept Discover cards.

3. How do I activate the rotating bonus categories on my Discover it Credit Card?

You can activate the rotating bonus categories on your Discover it Credit Card by logging in to your account and clicking on the “Activate” button for the current quarter’s bonus categories.

4. Can I earn cash back on balance transfers with the Discover it Credit Card?

No, you cannot earn cash back on balance transfers with the Discover it Credit Card. However, you can take advantage of the 0% introductory APR offer