The stock market is a dynamic environment that constantly experiences ups and downs. It serves as a platform for investors to buy and sell shares of various companies. In recent times, the market rally has been displaying some dangerous action, causing investors to pay close attention to specific stocks. This article will delve into the current state of the market rally and highlight the significance of closely monitoring companies like Tesla and AMD, along with the importance of EV chip plays.

Introduction

The stock market rally, characterized by a sustained upward movement in stock prices, has been subject to volatile conditions in recent times. Investors are keenly observing the market for signs of dangerous activities that could impact their investment portfolios. Two prominent companies, Tesla and AMD, have garnered significant attention due to their influence on the market rally. Additionally, EV chip plays, which involve companies that produce chips for electric vehicles, have become a crucial component of the market rally.

The current state of the market rally

The market rally has experienced mixed signals in recent weeks. While there have been periods of significant gains, there have also been instances of sudden drops and increased volatility. This erratic behavior has raised concerns among investors and prompted them to be vigilant.

The dangerous action to watch in the stock market

Identifying dangerous actions in the stock market is crucial for investors. It refers to market conditions that may indicate a potential downturn or increased risk. These signs can include sudden market sell-offs, increased market volatility, or negative news impacting specific industries or companies. Investors need to be aware of these warning signs to protect their investments.

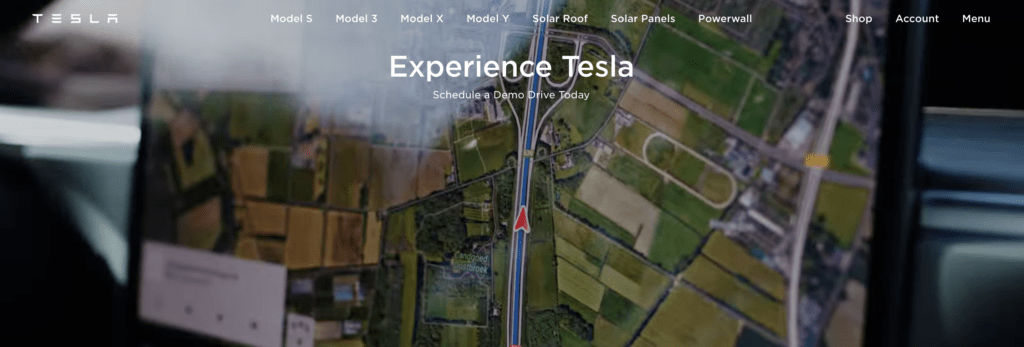

The Impact of Tesla on the market rally

Tesla, the electric vehicle pioneer, has played a significant role in the market rally. Its stock price has experienced substantial growth, making it one of the most valuable companies globally. The performance of Tesla’s stock often has a ripple effect on the broader market. Positive or negative movements in Tesla’s stock can influence investor sentiment and impact other electric vehicle-related stocks.

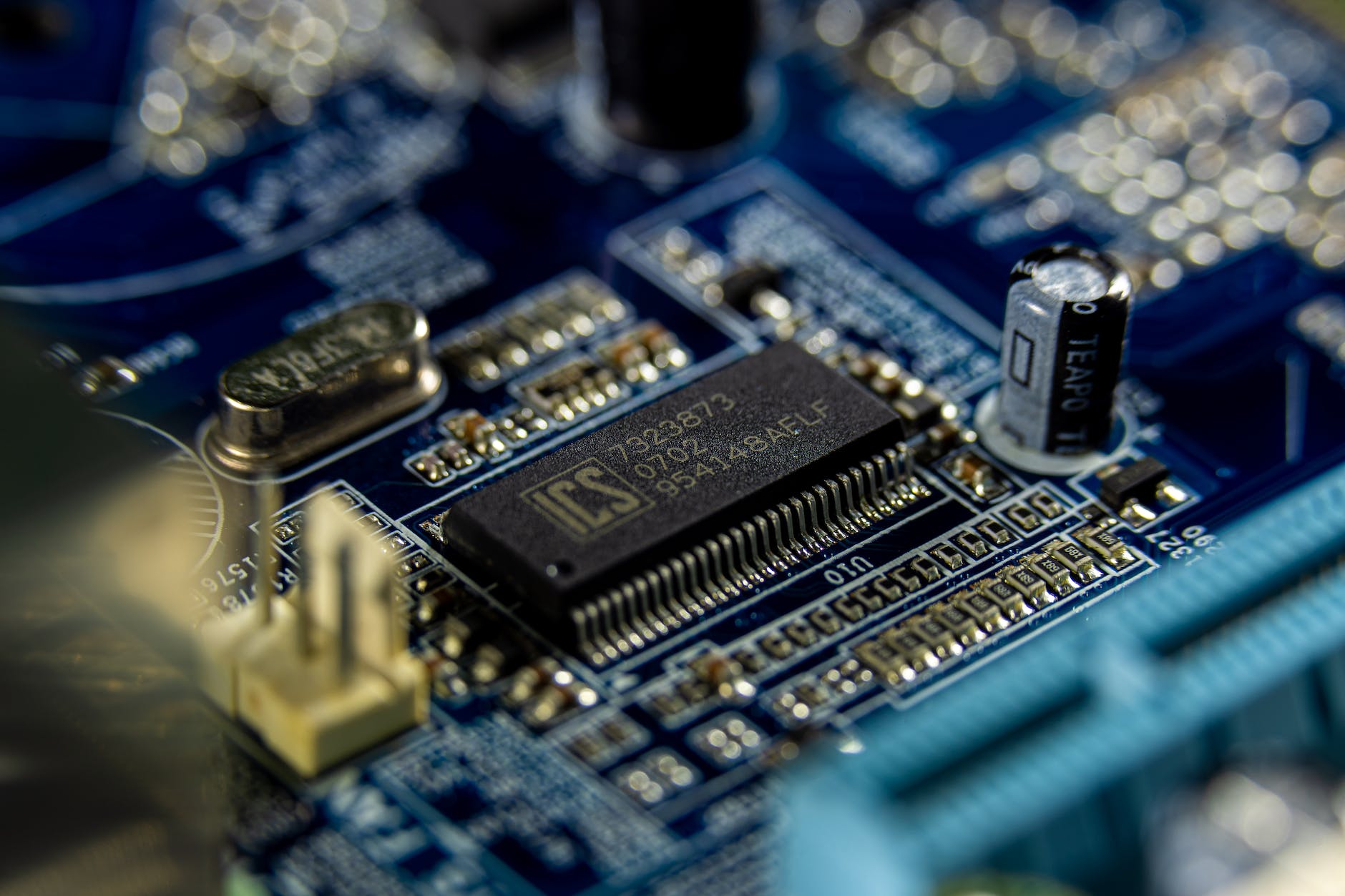

AMD and its Role in the market rally

AMD, a semiconductor company specializing in high-performance computing, has also contributed to the market rally. The demand for advanced computer processors and graphics cards has surged in recent years, and AMD has capitalized on this trend. Its innovative products and strong financial performance have attracted investors, leading to increased market value.

The importance of EV chips plays

EV chip plays have emerged as a crucial sector within the market rally. These companies specialize in producing chips that power electric vehicles. As the demand for electric vehicles continues to rise, the significance of EV chips and the companies manufacturing them has grown substantially. Investing in these EV chip plays can provide opportunities for investors to benefit from the electric vehicle revolution.

Potential Risks and Challenges in the market rally

While the market rally presents opportunities, it is not without risks. Investors need to be aware of potential challenges that could affect their investments. Some of these risks include market volatility, economic downturns, regulatory changes, and company-specific factors such as poor management or product failures. It is crucial to conduct thorough research and carefully assess the risk-reward profile before making investment decisions.

Strategies for Navigating the market rally

Navigating the market rally requires careful planning and strategic decision-making. Here are some strategies that can help investors navigate the current market conditions:

Diversify your portfolio: Spread your investments across different sectors and asset classes to reduce the impact of market volatility on your overall portfolio.

Stay informed: Stay updated with the latest market news, economic indicators, and company-specific developments that may impact your investments. Knowledge is key to making informed decisions.

Set realistic goals: Define your investment objectives and create a long-term investment plan. Avoid chasing short-term gains and focus on your long-term financial goals.

Keep emotions in check: Emotional decision-making can lead to impulsive actions that may harm your investment returns. Maintain a disciplined approach and stick to your investment strategy.

Regularly review and rebalance: Periodically review your portfolio to ensure it aligns with your investment goals. Rebalance if necessary to maintain the desired asset allocation.

Investing in Tesla and AMD: Pros and cons

Investing in companies like Tesla and AMD can offer potential benefits, but it’s important to consider the pros and cons before making investment decisions. Here are some factors to consider:

Tesla:

Pros:

- Leading player in the electric vehicle market.

- Continuous innovation and strong brand recognition.

- Potential for future growth in the clean energy sector.

Cons:

- High valuation and volatility in stock price.

- Intense competition in the electric vehicle market.

- Regulatory and supply chain risks.

AMD:

Pros:

- Strong performance in the semiconductor industry.

- Innovation and technological advancements.

- Diverse product portfolio and growing market share.

Cons:

- Competition from other semiconductor companies.

- Dependence on the cyclical nature of the technology industry.

- Potential for disruptions in the global supply chain.

The future of the market rally and EV chip plays

The future of the market rally and the importance of EV chip plays are closely intertwined. As the demand for electric vehicles continues to rise, the need for EV chips is expected to increase as well. Companies involved in the production of EV chips are likely to experience growth opportunities. However, it is important to carefully evaluate individual companies within the sector and consider their competitive advantages, financial health, and long-term prospects.

Conclusion

The market rally is exhibiting some dangerous actions that investors should closely monitor. Companies like Tesla and AMD, along with the growing importance of EV chip plays, have significant roles in shaping the market rally. Investors need to navigate the market rally with caution, considering the potential risks and challenges. By implementing sound investment strategies and conducting thorough research, investors can make informed decisions to maximize their chances of success.

Frequently Asked Questions

1. What are EV chip plays?

EV chip plays refer to companies that specialize in manufacturing chips for electric vehicles. These chips are crucial components that power various systems in electric vehicles, including battery management, power electronics, and advanced driver-assistance systems.

2. How can I identify dangerous actions in the stock market?

To identify dangerous action in the stock market, pay attention to sudden market sell-offs, increased market volatility, negative news impacting specific industries or companies, and any signs of an economic downturn.

3. What are the risks of investing in Tesla?

Investing in Tesla comes with certain risks. Some of the key risks include:

Volatility: Tesla’s stock price has shown high levels of volatility in the past, which can lead to significant fluctuations in investment value.

Competition: The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants vying for market share. This competition could impact Tesla’s growth and profitability.

Regulatory changes: Changes in government regulations, subsidies, or incentives related to electric vehicles can impact Tesla’s business operations and financial performance.

Supply chain challenges: Tesla relies on a complex global supply chain for components and materials. Disruptions in the supply chain, such as shortages or delays, can affect production and delivery schedules.

4. How does AMD contribute to the market rally?

AMD has played a significant role in the market rally due to several factors:

Strong performance: AMD has demonstrated consistent growth and financial success in recent years, which has attracted investor interest and contributed to the market rally.

Technological advancements: AMD’s innovative products in the semiconductor industry, particularly in high-performance computing, have positioned the company as a key player. The demand for advanced processors and graphics cards has driven AMD’s market value.

Industry partnerships: AMD has established partnerships with major technology companies, enhancing its market presence and opening up growth opportunities.

Expansion into new markets: AMD has successfully expanded into diverse markets beyond personal computers, such as data centers and gaming consoles, further fueling its market rally impact.

5. How can I navigate the market rally effectively?

Navigating the market rally effectively requires a thoughtful approach. Here are some tips:

Conduct thorough research: Before making any investment decisions, gather information about the companies you are considering and the broader market trends.

Diversify your portfolio: Spread your investments across different sectors, asset classes, and geographies to reduce risk and increase the potential for long-term returns.

Set realistic expectations: Avoid chasing short-term gains and focus on your long-term financial goals. Keep in mind that the market rally can experience fluctuations and volatility.

Stay informed: Stay updated with the latest market news, economic indicators, and company-specific developments that may impact your investments. Continuous learning is key to successful investing.

Seek professional advice if needed: If you are uncertain or unfamiliar with investing, consider consulting with a financial advisor who can provide personalized guidance based on your financial situation and goals.

Remember, successful navigation of the market rally requires careful analysis, disciplined decision-making, and a long-term perspective.

In conclusion, the market rally displays dangerous action that necessitates careful attention. Tesla and AMD, along with the prominence of EV chip plays, have significant roles in shaping the rally. By employing sound investment strategies, conducting thorough research, and being aware of potential risks, investors can make informed decisions to navigate the market rally effectively. Stay vigilant, stay informed, and adapt your investment approach to optimize your chances of success.