Introduction

Are you looking for a reliable and user-friendly online trading platform to manage your investments? Look no further than BMO InvestorLine. With its advanced features, comprehensive tools, and excellent customer support, BMO InvestorLine has become a go-to choice for both beginner and experienced investors. In this article, we will delve into the world of BMO InvestorLine, exploring its benefits, features, account opening process, fees, security measures, and more. By the end of this article, you’ll have a clear understanding of why BMO InvestorLine is a top choice for investors seeking a seamless trading experience.

Understanding BMO InvestorLine

BMO InvestorLine is an online brokerage platform offered by the Bank of Montreal (BMO). It provides individuals with a convenient and secure way to invest in a wide range of financial instruments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. With BMO InvestorLine, you can manage your investments anytime, anywhere, through a user-friendly online interface or a mobile app.

Benefits of Using BMO InvestorLine for Investments

When it comes to managing your investments, BMO InvestorLine offers several key benefits:

- Convenience and Accessibility: BMO InvestorLine allows you to access your investment portfolio 24/7, giving you the flexibility to monitor and make trades at your convenience.

- Advanced Trading Tools: The platform provides a wide range of advanced trading tools, such as real-time quotes, interactive charts, customizable watchlists, and in-depth research reports. These tools empower investors to make informed decisions and execute trades efficiently.

- Diverse Investment Options: BMO InvestorLine offers a vast selection of investment options, allowing you to build a diversified portfolio tailored to your investment goals and risk tolerance. Whether you’re interested in stocks, bonds, or mutual funds, BMO InvestorLine has you covered.

- Competitive Pricing: BMO InvestorLine offers competitive pricing for trades, ensuring that you can maximize your investment returns while keeping costs in check.

- Educational Resources: BMO InvestorLine provides educational resources and market insights to help you enhance your investment knowledge and make more informed decisions. These resources include webinars, articles, tutorials, and access to expert research.

Features and Tools Offered by BMO InvestorLine

BMO InvestorLine offers a wide range of features and tools to enhance your investment experience. Some notable ones include:

- Market Research: Access to comprehensive market research reports, analyst ratings, and company profiles to help you stay updated and make informed investment decisions.

- Real-time Quotes and Streaming: Get real-time quotes, streaming market data, and customizable watchlists to monitor your investments closely.

- Advanced Trading Platforms: BMO InvestorLine offers multiple trading platforms, including the award-winning “BMO InvestorLine self-directed” platform and the powerful “BMO MarketPro” platform for active traders.

- Portfolio Analysis: Utilize portfolio analysis tools to assess the performance of your investments, track your asset allocation, and identify areas for improvement.

- Automated Investing: BMO InvestorLine provides options for automated investing, such as pre-authorized contributions and automatic dividend reinvestment plans, making it easier to stay on track with your investment strategy.

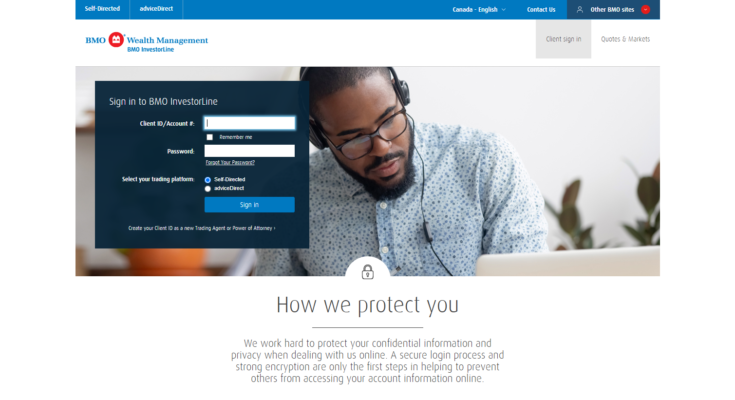

How to Open an Account with BMO InvestorLine

Opening an account with BMO InvestorLine is a straightforward process:

- Gather Required Documents: Ensure you have the necessary identification documents, proof of address, and financial information ready.

- Visit the BMO InvestorLine Website: Navigate to the BMO InvestorLine website and click on the “Open an Account” button.

- Choose the Account Type: Select the account type that suits your investment needs, such as a non-registered account, Tax-Free Savings Account (TFSA), or Registered Retirement Savings Plan (RRSP).

- Provide Personal and Financial Information: Fill in the required personal and financial information accurately and thoroughly.

- Submit the Application: Review your application and submit it electronically. BMO InvestorLine will verify your information and send you the necessary account details once your application is approved.

Tips for Using BMO InvestorLine Effectively

To make the most of your BMO InvestorLine experience, consider the following tips:

- Set Clear Investment Goals: Define your investment goals and risk tolerance to guide your investment decisions.

- Stay Informed: Stay updated on market trends, economic news, and company-specific developments to make informed investment choices.

- Utilize the Research Tools: Take advantage of BMO InvestorLine’s research tools, such as analyst reports and market insights, to gain valuable insights.

- Diversify Your Portfolio: Spread your investments across different asset classes and sectors to reduce risk and enhance potential returns.

- Regularly Review and Rebalance: Periodically review your investment portfolio and rebalance it to align with your investment objectives and risk tolerance.

BMO InvestorLine Fees and Charges

Before using any investment platform, it’s essential to understand the fees and charges involved. BMO InvestorLine charges fees for trades, account maintenance, and other services. The fee structure varies depending on the type of account and trading activity. It’s recommended to review the fee schedule on the BMO InvestorLine website or contact customer support for detailed information.

Security Measures and Protection

BMO InvestorLine takes security seriously and employs various measures to protect your investments and personal information. These measures include:

- Secure Online Access: BMO InvestorLine uses advanced encryption and authentication protocols to ensure secure access to your account.

- Fraud Protection: BMO InvestorLine implements robust fraud detection and prevention measures to safeguard your investments and personal data.

- Account Protection: BMO InvestorLine is a member of the Canadian Investor Protection Fund (CIPF), which provides protection to eligible investments in case of insolvency.

- Privacy Policy: BMO InvestorLine has a comprehensive privacy policy in place to safeguard your personal information and ensure its responsible use.

Customer Support and Resources

BMO InvestorLine offers excellent customer support and resources to assist you along your investment journey. You can reach out to their customer support team via phone, email, or live chat for assistance with your account, trading, or any other queries. Additionally, BMO InvestorLine provides a vast array of educational resources, including webinars, articles, tutorials, and FAQs, to help you enhance your investment knowledge.

Comparison with Other Online Trading Platforms

While there are several online trading platforms available, BMO InvestorLine stands out in terms of its user-friendly interface, comprehensive tools, educational resources, and exceptional customer support. However, it’s always a good idea to compare different platforms based on your specific needs and preferences to ensure you choose the one that aligns best with your investment goals.

Case Studies: Successful Investments with BMO InvestorLine

To further illustrate the effectiveness of BMO InvestorLine, let’s explore a couple of case studies highlighting successful investments made through the platform:

- Case Study 1: Sarah’s Retirement Portfolio: Sarah, a long-term investor, used BMO InvestorLine to build a diversified retirement portfolio comprising stocks, ETFs, and mutual funds. Over the years, she regularly reviewed and rebalanced her portfolio based on market conditions, resulting in consistent growth and a secure retirement future.

- Case Study 2: Mark’s Active Trading Strategy: Mark, an active trader, leveraged BMO InvestorLine’s advanced trading tools and real-time market data to execute quick trades and capitalize on short-term market movements. His diligent research and timely decision-making led to substantial profits and financial success.

Conclusion

BMO InvestorLine offers a comprehensive and user-friendly platform for individuals looking to manage their investments effectively. With its wide range of features, advanced tools, educational resources, and exceptional customer support, BMO InvestorLine has established itself as a top choice for investors of all levels of experience. Whether you’re a beginner or an experienced investor, BMO InvestorLine provides the necessary tools and resources to help you achieve your financial goals.

Frequently Asked Questions

- Is BMO InvestorLine suitable for beginners? Yes, BMO InvestorLine is beginner-friendly and provides educational resources to help beginners understand the basics of investing.

- Can I trade on BMO InvestorLine using a mobile app? Yes, BMO InvestorLine offers a mobile app that allows you to manage your investments on the go.

- Are there any account minimums to open an account with BMO InvestorLine? Yes, certain account types may have minimum balance requirements. It’s recommended to check the specific requirements on the BMO InvestorLine website.

- Is my personal information safe with BMO InvestorLine? Yes, BMO InvestorLine employs advanced security measures to protect your personal information and investments.

- How can I contact BMO InvestorLine’s customer support? You can contact BMO InvestorLine’s customer support through phone, email, or live chat. Visit their website for the contact details.