Introduction:

In today’s world, having a reliable credit card is essential for managing your finances effectively. With numerous credit card options available, it’s important to choose one that suits your needs and offers attractive benefits. Discover Credit Card is a prominent player in the market, known for its exceptional rewards program and customer-friendly features. In this article, we will explore the Discover credit card in detail, highlighting its benefits, types, application process, cash back program, account management, fees, and tips for maximizing its benefits. Let’s dive in and discover the world of Discover credit cards!

Benefits of Using a Discover Credit Card

- Cash back Rewards: Discover credit cards are renowned for their generous cash back rewards program. Cardholders can earn cash back on every purchase they make, which can be redeemed for statement credits, gift cards, or even direct deposits to their bank accounts. This enticing feature allows users to earn rewards while spending money on everyday expenses.

- Introductory APR Offers: Discover credit cards often come with attractive introductory APR offers, providing cardholders with a 0% APR on purchases and balance transfers for a specified period. This benefit can save money on interest charges and allow users to pay off existing debts more efficiently.

- No Annual Fee: unlike many credit cards, Discover offers a range of cards with a annual fee. This means cardholders can enjoy the benefits and rewards without having to pay an annual fee, making it an appealing option for cost-conscious consumers.

- FICO® Credit Score Tracking: Discover provides its cardholders with free access to their FICO® credit score, empowering them to monitor their credit health. This feature helps users understand their financial standing and make informed decisions to improve their creditworthiness.

- Fraud Protection: Discover takes customer security seriously and offers robust fraud protection measures. Cardholders benefit from features like real-time fraud monitoring, $0 fraud liability guarantee, and alerts for suspicious activity, providing peace of mind and ensuring a secure financial experience.

Different Types of Discover Credit Cards

Discover offers a range of credit cards to cater to different consumer needs. Here are some of the popular Discover credit card options:

- Discover it® Cash Back: This card is designed for individuals who want to earn cash back on their everyday purchases. It offers rotating quarterly cash back categories, where cardholders can earn up to 5% cash back on eligible purchases.

- Discover it® Miles: Travel enthusiasts can benefit from the Discover it® Miles card, which offers unlimited 1.5x miles on every dollar spent. These miles can be redeemed for travel expenses, making it a great option for frequent flyers.

- Discover it® Student Cash Back: Designed specifically for students, this card helps build credit history while earning cash back rewards. It offers similar benefits as the Discover it® Cash Back card, with additional rewards for good grades.

- Discover it® Secured: For individuals looking to establish or rebuild their credit, the Discover it® Secured card is an excellent choice. It requires a security deposit and provides an opportunity to demonstrate responsible credit usage.

How to Apply for a Discover Credit Card

Applying for a Discover credit card is a straightforward process. Here are the steps to follow:

- Online Application Process: Visit the Discover website and navigate to the credit cards section. Select the specific card you are interested in and click on the “Apply Now” button. You will be directed to an online application form.

- Required Information: Fill the application form with accurate personal information, including your full name, contact details, social security number, date of birth, and income details. Ensure the information provided is correct and up to date.

- Credit Check: Discover will perform a credit check as part of the application process. This involves assessing your credit history and creditworthiness to determine your eligibility for the credit card. It’s important to have a good credit score to increase your chances of approval.

- Verification and Approval: After submitting the application, Discover will review the information provided and verify your identity. This may involve additional documentation or verification steps. If your application is approved, you will receive a notification regarding your credit limit and card details.

- Card Activation: Once you receive your Discover credit card in the mail, you will need to activate it before you can start using it. This can usually be done online or by calling the activation number provided with the card.

- Terms and Conditions: It’s crucial to familiarize yourself with the terms and conditions of your Discover credit card. Understand the interest rates, fees, and any special offers or rewards associated with your card. This will help you make the most of your credit card benefits while using it responsibly.

By following these steps, you can successfully apply for a Discover credit card and enjoy its various features and benefits.

Understanding the Discover Cash back Program

One of the most enticing aspects of owning a Discover credit card is the cash back rewards program. Here’s what you need to know about the Discover Cash back program:

- Cash back Categories: Discover credit cards often have rotating quarterly cash back categories. These categories change every three months and typically include popular spending areas such as groceries, gas stations, restaurants, and online shopping. By making purchases within these categories, cardholders can earn a higher percentage of cash back.

- Redemption Options: Discover provides multiple options for redeeming your cash back rewards. You can choose to redeem it as a statement credit, which reduces your outstanding balance. Alternatively, you can opt for gift cards from popular retailers or even direct deposits to your bank account. Discover also offers the option to use your cash back rewards for purchases on popular online retailers’ websites.

- Cash back Match: For new card members, Discover offer an exciting feature called Cash back Match. This means that at the end of your first year as a card member, Discover will match all the cash back you’ve earned during that time, effectively doubling your rewards. This is a significant perk that can maximize your earnings in the first year.

The Discover Cash back program is a valuable feature that allows cardholders to earn rewards on their everyday purchases. By taking advantage of the rotating categories and redemption options, you can make the most of your Discover credit card and enjoy the benefits it offers.

Managing Your Discover Credit Card Account

Once you have a Discover credit card, it’s important to manage your account effectively. Discover provides various tools and features to help you stay on top of your finances. Here’s how you can manage your Discover credit card account:

- Online Account Access: Discover offers a user-friendly online portal that allows you to access and manage your credit card account. By logging in to your account, you can view your balance, transactions, payment due dates, and available credit. This convenient feature enables you to monitor your account activity from anywhere at any time.

- Mobile App Features: Discover’s mobile app provides added convenience, allowing you to manage your credit card account on the go. Through the app, you can check your balance, make payments, set up account alerts, and even freeze your card temporarily if it’s misplaced or lost. The mobile app puts control at your fingertips and ensures a seamless user experience.

- Payment Options: Discover offers multiple payment options to suit your preferences. You can make payments online through the website or mobile app by linking your bank account for easy transfers. Alternatively, you can set up automatic payments to ensure your bills are paid on time every month. Discover also accepts payments by mail if you prefer traditional methods.

- Credit Limit Increase: As you build a positive credit history with your Discover credit card, you may become eligible for a credit limit increase. A higher credit limit can provide more financial flexibility and may positively impact your credit utilization ratio. You can request a credit limit increase through your online account or by contacting Discover’s customer service.

Managing your Discover credit card account effectively allows you to stay organized, track your spending, and make timely payments. By taking advantage of the online tools and features provided, you can ensure a smooth and convenient experience while enjoying the benefits of your Discover credit card.

Discover Credit Card Fees and Charges

While Discover credit cards offer attractive benefits, it’s important to be aware of the associated fees and charges. Here are some common fees to consider:

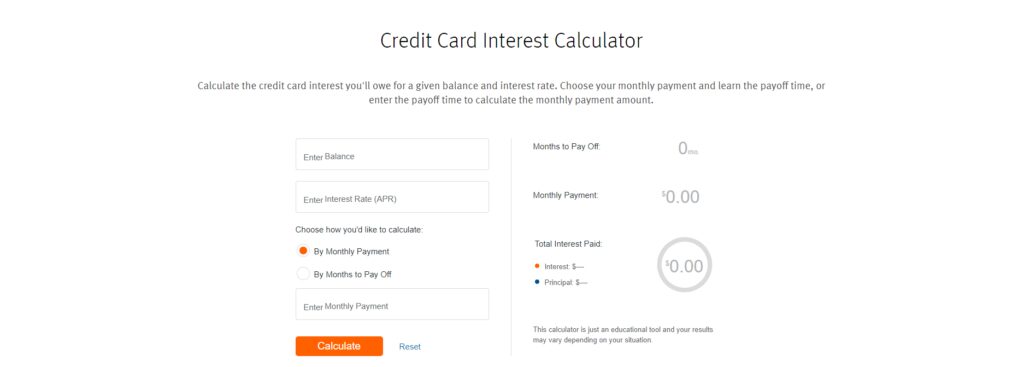

- Annual Percentage Rate (APR): Discover credit cards have an APR that applies to balances carried over from month to month. The specific APR can vary based on factors such as creditworthiness and the type of card. It’s essential to understand the APR and manage your payments to avoid accruing excessive interest charges.

- Balance Transfer Fees: If you choose to transfer a balance from another credit card to your Discover card, a balance transfer fee may apply. This fee is typically a percentage of the transferred amount. It’s important to consider this fee when deciding whether a balance transfer is beneficial for your financial situation.

- Late Payment Fees: Failing to make your credit card payment by the due date can result in late payment fees. These fees can vary based on the outstanding balance and are typically charged in addition to any interest that may accrue. It’s crucial to make payments on time to avoid these fees and maintain a positive credit history.

- Foreign Transaction Fees: When using your Discover credit card for purchases made in a foreign currency or outside of your home country, foreign transaction fees may apply. These fees are typically a percentage of the transaction amount. If you frequently travel internationally or make purchases from foreign merchants, it’s important to consider these fees.

Understanding the fees and charges associated with your Discover credit card allows you to make informed decisions and manage your finances effectively. By being mindful of these fees and using your card responsibly, you can maximize the benefits and rewards while minimizing any potential costs.

Tips for Maximizing Your Discover Credit Card Benefits

To make the most of your Discover credit card and enjoy its benefits to the fullest, consider the following tips:

- Utilize Cash back Categories: Take advantage of the rotating cash back categories offered by Discover. Plan your purchases to align with these categories and earn higher cash back percentages. Stay updated on the current categories and maximize your rewards by using your Discover card for eligible purchases.

- Pay on Time and in Full: To avoid accruing interest charges, make it a habit to pay your credit card bill on time and in full each month. By doing so, you can enjoy the benefits of your card without incurring unnecessary debt.

- Take Advantage of Introductory APR Offers: If your Discover credit card comes with an introductory APR offer on purchases or balance transfers, make strategic use of it. Use the interest-free period to pay off existing debts or make larger purchases without worrying about immediate interest charges.

- Monitor Your Credit Score: Discover provides access to your FICO® credit score, enabling you to track your credit health. Regularly monitor your score and take steps to improve it if necessary. A higher credit score can open doors to better credit card offers and financial opportunities in the future.

By implementing these tips, you can maximize the benefits of your Discover credit card, earn valuable rewards, and maintain a healthy credit profile.

Discover Credit Card Customer Service and Support

Discover is committed to providing excellent customer service and support to its cardholders. Here are some ways you can access assistance:

- Phone and Online Support: Discover offers customer service support through phone and online channels. If you have any questions, concerns, or need assistance with your credit card, you can reach out to Discover’s customer service representatives via the provided phone number or through their online contact options.

- Fraud Protection Services: Discover prioritizes the security of its customers’ accounts. If you suspect fraudulent activity or unauthorized charges on your credit card, promptly contact Discover’s customer service. They have robust fraud protection measures in place and can guide you through the necessary steps to resolve any issues.

Discover’s customer service team is available to address your inquiries, provide assistance, and ensure a positive experience with your Discover credit card.

Conclusion

Discover credit cards offer an array of benefits, including cash back rewards, introductory APR offers, no annual fees, credit score tracking, and fraud protection. By choosing the right Discover credit card and utilizing its features effectively, you can enhance your financial journey and earn valuable rewards on your everyday purchases. Remember to manage your account responsibly, make payments on time, and stay informed about the various fees and charges. Discover’s customer service is there to support you along the way. Take control of your finances with a Discover credit card and enjoy the perks it brings.

FAQs (Frequently Asked Questions)

- How do I apply for a Discover credit card? Applying for a Discover credit card is simple. Visit the Discover website, select the card you’re interested in, and complete the online application form with accurate information. Discover will review your application and provide a response.

- What is the Discover Cash back Match? Discover Cash back Match is a feature available to new card members. At the end of your first year, Discover will match all the cash back you’ve earned, doubling your rewards.

- Can I use my Discover credit card internationally? Yes, Discover credit cards are widely accepted internationally. However, keep in mind that foreign transaction fees may apply to purchases made in a foreign currency.

- How can I increase my credit limit on my Discover card? You can request a credit limit increase through your Discover online account or by contacting Discover’s customer service. Provide information about your income, employment status, and any changes in your financial situation that may warrant a credit limit increase. Discover will review your request and determine if an increase is possible based on your creditworthiness and payment history.

- Is there a fee for balance transfers on Discover credit cards? Yes, there is typically a balance transfer fee for transferring a balance from another credit card to your Discover card. The fee is a percentage of the transferred amount. It’s important to consider this fee when deciding whether a balance transfer is the right option for you.

- What happens if I miss a payment on my Discover credit card? If you miss a payment on your Discover credit card, you may be subject to late payment fees. These fees can vary based on the outstanding balance and are typically charged in addition to any interest that may accrue. It’s essential to make your payments on time to avoid these fees and maintain a positive credit history.

- What should I do if I suspect fraudulent activity on my Discover credit card? If you notice any suspicious activity or unauthorized charges on your Discover credit card, contact Discover’s customer service immediately. They have robust fraud protection measures in place to assist you. Prompt reporting can help prevent further unauthorized transactions and ensure the security of your account.

- Can I access my Discover credit card account through a mobile app? Yes, Discover provides a mobile app that allows you to access and manage your credit card account conveniently. The mobile app offers features such as checking your balance, making payments, setting up account alerts, and even temporarily freezing your card if needed.

Remember, these FAQs provide general information, and it’s always recommended to consult Discover’s official website or contact their customer service for specific details related to your credit card account.

Great content! Super high-quality! Keep it up!

I want to thank you for your assistance and this post. It’s been great.

Thank you for writing this post. I like the subject too.

Please provide me with more details on the topic

Thank you for providing me with these article examples. May I ask you a question?

Thank you for your help and this post. It’s been great.

Thank you for being of assistance to me. I really loved this article.

Your articles are extremely helpful to me. Please provide more information!

Thank you for being of assistance to me. I really loved this article.

Your articles are very helpful to me. May I request more information?

Thank you for your articles. They are very helpful to me. May I ask you a question?

Thank you for writing this post!

Thanks for posting. I really enjoyed reading it, especially because it addressed my problem. It helped me a lot and I hope it will help others too.

I enjoyed reading your piece and it provided me with a lot of value.

You’ve the most impressive websites.

I’d like to find out more? I’d love to find out more details.

I really appreciate your help

Your articles are very helpful to me. May I request more information?

I enjoyed reading your piece and it provided me with a lot of value.

You helped me a lot with this post. I love the subject and I hope you continue to write excellent articles like this.

Your articles are extremely helpful to me. May I ask for more information?

May I request more information on the subject? All of your articles are extremely useful to me. Thank you!

I’d like to find out more? I’d love to find out more details.

The articles you write help me a lot and I like the topic

I want to thank you for your assistance and this post. It’s been great.

Thanks for your help and for writing this post. It’s been great.

Please tell me more about this. May I ask you a question?

Sustain the excellent work and producing in the group!

Thank you for your post. I really enjoyed reading it, especially because it addressed my issue. It helped me a lot and I hope it will also help others.

I want to thank you for your assistance and this post. It’s been great.

May I request that you elaborate on that? Your posts have been extremely helpful to me. Thank you!

You’ve been great to me. Thank you!

Sustain the excellent work and producing in the group!

The articles you write help me a lot and I like the topic

The articles you write help me a lot and I like the topic

May I request that you elaborate on that? Your posts have been extremely helpful to me. Thank you!

You’ve the most impressive websites.

You helped me a lot by posting this article and I love what I’m learning.

Thank you for your articles. I find them very helpful. Could you help me with something?

Please tell me more about this. May I ask you a question?

May I request more information on the subject? All of your articles are extremely useful to me. Thank you!

Thank you for writing this post!

Great content! Super high-quality! Keep it up!

Thank you for being of assistance to me. I really loved this article.

I’m so in love with this. You did a great job!!

I enjoyed reading your piece and it provided me with a lot of value.

Thanks for posting. I really enjoyed reading it, especially because it addressed my problem. It helped me a lot and I hope it will help others too.

I’m so in love with this. You did a great job!!

Some really superb info , Sword lily I found this.