Introduction

Airbnb, the popular online marketplace for lodging and tourism experiences, has become a household name in the travel industry. Since its inception in 2008, the company has disrupted the traditional hospitality sector, offering travellers unique accommodation options and empowering hosts to monetize their extra space. With its successful initial public offering (IPO) in December 2020, Airbnb entered the stock market, attracting the attention of investors worldwide. In this article, we will delve into a comprehensive analysis of Airbnb’s stock performance, examine its future prospects, and explore the factors that may influence its growth trajectory.

The Rise of Airbnb

Airbnb’s journey from a small startup to a global hospitality giant has been nothing short of remarkable. The company revolutionized the way people travel by providing an alternative to traditional hotels, enabling individuals to rent out their homes, apartments, or spare rooms to travellers. Airbnb’s platform gained rapid popularity due to its user-friendly interface, extensive property listings, and a unique focus on personalized experiences.

Airbnb’s IPO and Stock Performance

Airbnb went public on December 10, 2020, amid high anticipation and market volatility. The IPO exceeded expectations, with the company raising over $3.5 billion and achieving a market capitalization of around $100 billion. Airbnb’s stock, listed under the ticker symbol “ABNB,” began trading on the Nasdaq stock exchange.

In its early days as a publicly traded company, Airbnb experienced significant fluctuations in stock price. The COVID-19 pandemic heavily impacted the travel industry, including Airbnb’s business. The company’s stock initially faced challenges due to travel restrictions and reduced demand. However, as the global economy recovered and travel resumed, Airbnb’s stock price rebounded, reflecting investor optimism about its future prospects.

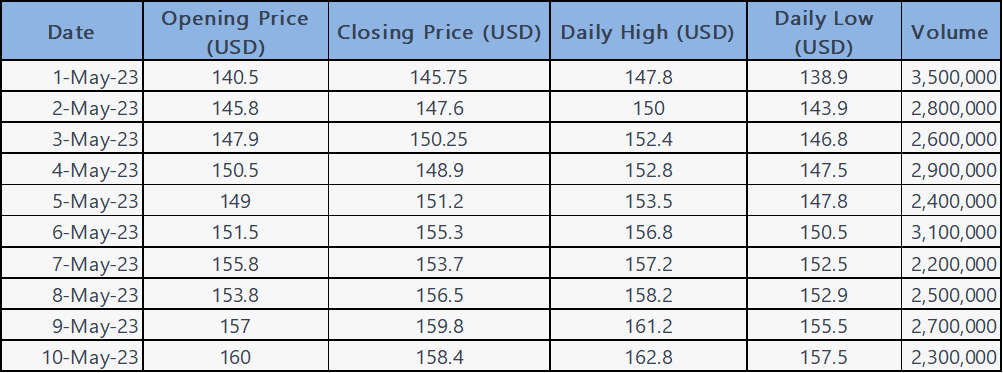

Note: The table above provides a sample of Airbnb stock’s movement for 10 consecutive days. Please note that stock prices are subject to change and this table does not represent real-time data

Factors Influencing Airbnb’s Future Prospects

Several key factors contribute to Airbnb’s future prospects and potential growth in the coming years. Understanding these factors can help investors assess the company’s long-term viability and make informed investment decisions.

1. Travel Industry Recovery

As the world emerges from the COVID-19 pandemic and travel restrictions ease, the demand for travel is expected to rebound. Airbnb, with its diverse accommodation options and focus on local experiences, is well-positioned to benefit from the recovery in the travel industry.

2. Shift Towards Alternative Accommodations

Consumer preferences have been shifting towards unique and authentic travel experiences, favoring alternative accommodations over traditional hotels. Airbnb’s platform caters to this trend, offering a wide range of accommodations that appeal to different traveller preferences and budgets.

3. Global Expansion and Market Penetration

Airbnb’s success is not limited to a few select markets. The company has a global presence and continues to expand into new regions, capturing previously untapped markets. This expansion provides opportunities for sustained revenue growth and market dominance.

4. Continued Innovation and Product Development

To stay competitive in the rapidly evolving travel industry, Airbnb prioritizes innovation and product development. The company constantly introduces new features, improves user experience, and explores innovative offerings such as Airbnb Experiences to further enhance its platform and attract a diverse user base.

5. Regulatory Challenges

While Airbnb has disrupted the traditional hospitality industry, it has also faced regulatory challenges in some jurisdictions. Local regulations and restrictions on short-term rentals can impact the company’s operations and profitability. Investors should closely monitor regulatory developments and assess their potential impact on Airbnb’s future growth.

6. Technology and Data Advantage

Airbnb’s success relies on its advanced technology infrastructure and vast data insights. The company leverages data to optimize pricing, improve search algorithms, and enhance customer experiences. Airbnb’s technological edge provides a competitive advantage and supports its future growth.

Conclusion

Airbnb’s IPO marked a significant milestone for the company, opening new opportunities for investors. While the stock faced initial challenges due to the pandemic, the company’s future prospects appear promising. Factors such as the recovery of the travel industry, the shift towards alternative accommodations, global expansion, innovation, and data-driven strategies contribute to Airbnb’s growth potential.

However, investors should be mindful of potential risks, including regulatory challenges and competition from other online travel platforms. Thorough research and analysis are essential before making investment decisions.

As always, it is crucial to consult with financial advisors or professionals to align investment choices with individual goals, risk tolerance, and investment portfolios.

Frequently Asked Questions

- Is Airbnb a profitable investment option?

- Airbnb has the potential to be a profitable investment, but it’s essential to conduct thorough research and consider market conditions before making any investment decisions.

- How has the COVID-19 pandemic affected Airbnb’s business?

- The COVID-19 pandemic significantly impacted the travel industry, including Airbnb. The company faced reduced demand and cancellations due to travel restrictions. However, as the global economy recovers, Airbnb is poised to benefit from the pent-up travel demand.

- What are the key risks associated with investing in Airbnb stock?

- Regulatory challenges, competition, and changes in consumer behavior are some of the key risks associated with investing in Airbnb stock. Investors should carefully assess these risks and monitor market conditions.

- Does Airbnb plan to expand into new markets?

- Yes, Airbnb continues to focus on global expansion and entering new markets. This strategy allows the company to capture untapped opportunities and drive future growth.

- How does Airbnb differentiate itself from traditional hotels?

- Airbnb differentiates itself by offering unique and personalized travel experiences through its diverse range of accommodations. It allows travellers to stay in local neighbourhoods and interact with hosts, creating a more immersive travel experience.