Introduction

In today’s fast-paced world, achieving financial success and securing a prosperous future requires strategic planning and smart investment decisions. However, navigating the complex landscape of wealth management can be overwhelming for many individuals. That’s where Citi Wealth Builder comes in—a comprehensive investment solution offered by Citibank that aims to empower individuals to build their path to financial success. In this article, we will explore the features, benefits, and strategies behind Citi Wealth Builder, and how it can help individuals achieve their long-term financial goals.

Understanding Citi Wealth Builder

Citi Wealth Builder is a holistic investment program designed to provide individuals with a systematic and disciplined approach to wealth creation. It combines the expertise of Citibank’s financial advisors with the convenience of modern digital tools, enabling clients to take control of their investment journey. With Citi Wealth Builder, individuals can access a wide range of investment options, personalized advice, and ongoing support, all tailored to their unique financial goals and risk appetite.

Features and Benefits of Citi Wealth Builder

Diversified Investment Portfolio

One of the key features of Citi Wealth Builder is the ability to create a diversified investment portfolio. Diversification is a proven strategy to manage risk and maximize returns. With Citi Wealth Builder, clients can choose from a variety of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs), allowing them to spread their investments across different asset classes and industries.

Personalized Investment Advice

Citi Wealth Builder provides clients with access to a team of experienced financial advisors who can offer personalized investment advice. These advisors take into consideration the client’s financial goals, risk tolerance, and investment horizon to create a customized investment plan. Whether an individual is planning for retirement, saving for a child’s education, or seeking long-term wealth creation, the advisors at Citi Wealth Builder can help devise a strategy that aligns with their specific needs.

Regular Portfolio Reviews

To ensure that the investment strategy remains on track, Citi Wealth Builder offers regular portfolio reviews. These reviews help clients stay informed about the performance of their investments and make any necessary adjustments to their portfolio. By monitoring the portfolio’s progress, clients can make informed decisions and take advantage of market opportunities while minimizing potential risks.

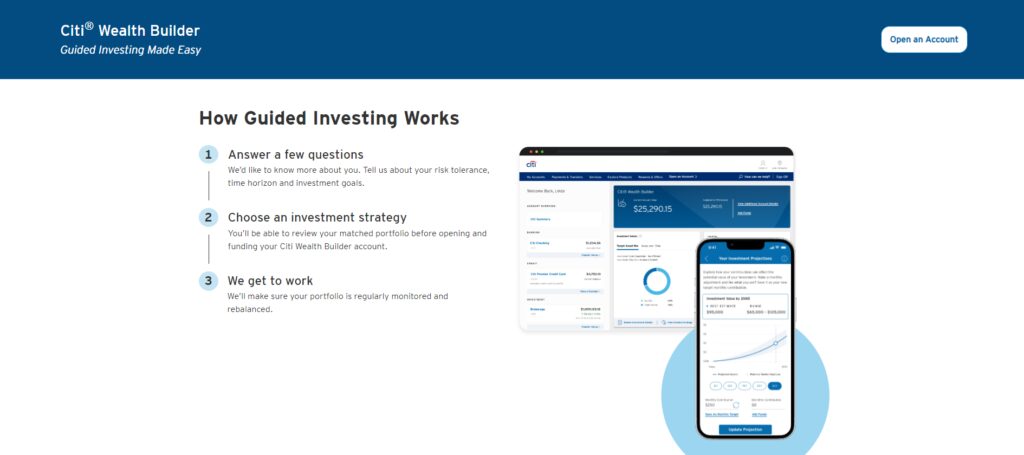

Convenient Digital Platform

Citi Wealth Builder leverages modern digital technology to provide clients with a seamless and convenient investment experience. The platform offers a user-friendly interface that allows clients to view their investment portfolio, track performance, and access relevant financial information. Additionally, clients can perform transactions, such as buying or selling securities, online, saving them time and effort.

Tax-Efficient Strategies

Efficient tax planning is an essential aspect of wealth management. Citi Wealth Builder offers tax-efficient investment strategies that aim to minimize the impact of taxes on investment returns. By strategically structuring investments and utilizing tax-efficient products, clients can optimize their after-tax returns, thereby maximizing their wealth accumulation over time.

Strategies for Building Wealth with Citi Wealth Builder

Goal Setting

The first step in building wealth with Citi Wealth Builder is to establish clear financial goals. Whether it’s saving for retirement, buying a house, or funding a child’s education, setting specific and measurable goals allows individuals to focus their investment strategy. Citi Wealth Builder’s financial advisors can help clients define realistic goals and develop a plan to achieve them.

Asset Allocation

Asset allocation is a critical component of any investment strategy. It involves dividing investments across different asset classes, such as stocks, bonds, and cash equivalents, to achieve a balance between risk and return. Citi Wealth Builder’s advisors can guide clients in determining the optimal asset allocation based on their risk appetite and investment objectives.

Systematic Investing

Citi Wealth Builder encourages systematic investing, also known as dollar-cost averaging. This approach involves investing a fixed amount of money at regular intervals, regardless of market conditions. By investing consistently over time, individuals can potentially benefit from market fluctuations, as they buy more shares when prices are low and fewer shares when prices are high. This strategy helps reduce the impact of short-term market volatility and allows for long-term wealth accumulation.

Regular Rebalancing

Market movements can cause deviations from the original asset allocation. Therefore, regular rebalancing is crucial to maintain the desired risk and return profile of the investment portfolio. Citi Wealth Builder provides clients with periodic portfolio reviews and rebalancing recommendations to ensure that their investments stay aligned with their goals.

Long-Term Focus

Building wealth requires a long-term perspective. While short-term market fluctuations can be unsettling, it’s important to stay focused on the long-term objectives. Citi Wealth Builder emphasizes the importance of staying invested and avoiding knee-jerk reactions to market volatility. By maintaining a disciplined approach and adhering to the investment plan, individuals can harness the power of compounding and achieve their financial goals over time.

Conclusion

Citi Wealth Builder offers individuals a comprehensive wealth management solution that combines personalized advice, diversified investment options, and convenient digital tools. With its focus on long-term wealth creation and disciplined investing, Citi Wealth Builder empowers individuals to take control of their financial future. By setting clear goals, employing strategic asset allocation, and leveraging the expertise of Citibank’s financial advisors, clients can embark on a path to financial success and secure a prosperous future.

Frequently Asked Questions

- What is Citi Wealth Builder?

Citi Wealth Builder is a comprehensive investment program offered by Citibank that provides individuals with a systematic and disciplined approach to wealth creation. It combines personalized advice, diversified investment options, and digital tools to help individuals achieve their financial goals.

- What are the key features of Citi Wealth Builder?

Citi Wealth Builder offers several key features, including:

- Diversified investment portfolio options.

- Personalized investment advice from experienced financial advisors.

- Regular portfolio reviews to monitor performance and make adjustments.

- Convenient digital platform for easy access to investment information and transactions.

- Tax-efficient strategies to minimize the impact of taxes on investment returns.

- How can Citi Wealth Builder help me achieve my financial goals?

Citi Wealth Builder provides personalized investment advice tailored to your specific financial goals, risk tolerance, and investment horizon. By offering a diversified portfolio, regular portfolio reviews, and tax-efficient strategies, Citi Wealth Builder aims to maximize returns and help you build long-term wealth.

- Can I choose my own investments with Citi Wealth Builder?

Yes, Citi Wealth Builder allows you to choose from a variety of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). However, it is recommended to consult with the financial advisors at Citi Wealth Builder to ensure your investment choices align with your goals and risk appetite.

- How often will my portfolio be reviewed?

Citi Wealth Builder offers regular portfolio reviews to assess the performance of your investments. The frequency of these reviews may vary based on your investment objectives and market conditions. Your financial advisor will provide guidance on the appropriate timing for portfolio reviews.

- Is there a minimum investment requirement for Citi Wealth Builder?

Yes, there is typically a minimum investment requirement to enroll in Citi Wealth Builder. The specific minimum investment amount may vary based on the country and regulations. It is best to consult with a Citibank representative or financial advisor to determine the minimum investment requirement in your region.

- Can I access my Citi Wealth Builder account online?

Yes, Citi Wealth Builder provides a convenient digital platform that allows you to access your investment portfolio online. You can view your portfolio, track performance, and perform transactions, such as buying or selling securities, through the online platform.

- Is Citi Wealth Builder suitable for retirement planning?

Yes, Citi Wealth Builder can be used for retirement planning. The financial advisors at Citi Wealth Builder can help you create an investment strategy that aligns with your retirement goals, considering factors such as your desired retirement age, income needs, and risk tolerance.

- Can I withdraw my investments at any time?

While Citi Wealth Builder aims to support long-term wealth creation, you may have the flexibility to withdraw your investments, subject to certain terms and conditions. It is important to review the specific withdrawal policies and any associated fees or penalties with your financial advisor or Citibank representative.

- Is Citi Wealth Builder available globally?

Citi Wealth Builder is offered by Citibank in various countries; however, availability may vary by region. It is recommended to check with your local Citibank branch or visit their official website to confirm if Citi Wealth Builder is available in your country.

Disclaimer: Citi Wealth Builder is a product offered by Citibank. The information provided in this article is for informational purposes only and should not be considered as financial advice. Individuals are advised to consult with a qualified financial advisor or professional before making any investment decisions.