Introduction

When it comes to choosing a travel credit card, the options can be overwhelming. However, one card that stands out from the crowd is the Chase Freedom Unlimited. With its impressive rewards program and numerous benefits, the Chase Freedom Unlimited is a popular choice for travelers seeking to maximize their savings and earn valuable rewards. In this comprehensive guide, we will explore the features, benefits, and tips for making the most of your Chase Freedom Unlimited travel credit card.

Table of Contents

- How Does the Chase Freedom Unlimited Work?

- The Benefits of Chase Freedom Unlimited

- How to Apply for a Chase Freedom Unlimited Card

- Understanding the Rewards Program

- 4.1 Cash Back Rewards

- 4.2 Bonus Categories

- 4.3 Introductory Offers

- Tips for Maximizing Your Rewards

- 5.1 Take Advantage of Bonus Categories

- 5.2 Combine with Chase Ultimate Rewards

- 5.3 Redeeming Your Rewards

- Travel Benefits and Perks

- 6.1 Travel Insurance

- 6.2 No Foreign Transaction Fees

- 6.3 Airport Lounge Access

- Managing Your Chase Freedom Unlimited Account

- 7.1 Online Account Management

- 7.2 Setting Up AutoPay

- 7.3 Contacting Customer Service

- Frequently Asked Questions (FAQs)

- 8.1 How do I earn cash back with the Chase Freedom Unlimited?

- 8.2 Can I use my Chase Freedom Unlimited card internationally?

- 8.3 What is the minimum credit score required for approval?

- 8.4 Is there an annual fee for the Chase Freedom Unlimited?

- 8.5 How long does it take to receive my Chase Freedom Unlimited card?

How Does the Chase Freedom Unlimited Work?

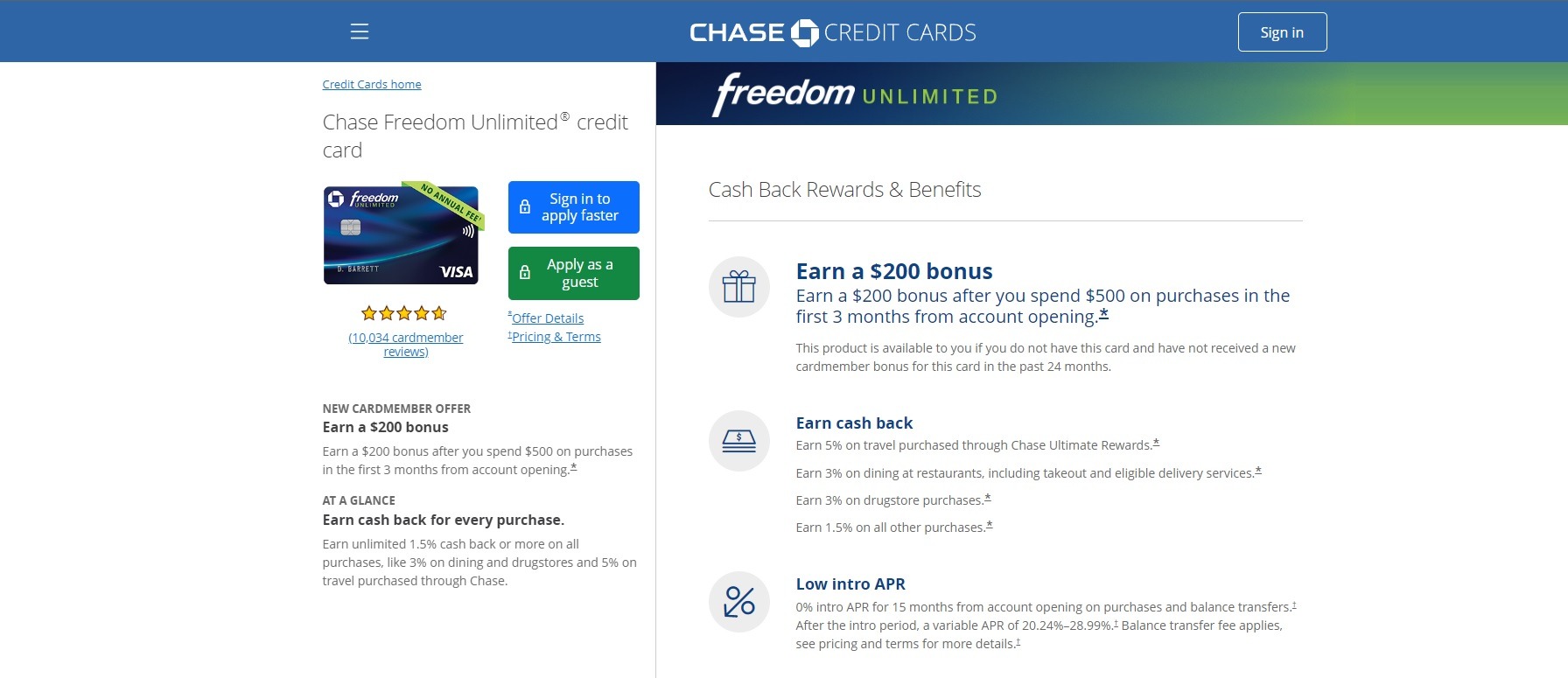

The Chase Freedom Unlimited is a rewards credit card that offers cash back on purchases. It operates on a simple and straightforward system, allowing cardholders to earn cash back on every purchase they make. Unlike some other credit cards, the Chase Freedom Unlimited does not limit rewards to specific spending categories, making it a versatile option for those seeking flexibility.

The Benefits of Chase Freedom Unlimited

The Chase Freedom Unlimited comes with a range of benefits that make it an attractive choice for travelers. Some of the key benefits include:

- Generous cash back rewards on all purchases

- No annual fee

- Introductory 0% APR period on purchases and balance transfers

- Flexible redemption options

- Travel and purchase protection benefits

How to Apply for a Chase Freedom Unlimited Card

Applying for a Chase Freedom Unlimited card is a simple and straightforward process. You can apply online through the Chase website or visit a local branch to complete an application in person. The application typically requires personal information such as your name, address, employment details, and social security number.

4.Understanding the Rewards Program

The rewards program of the Chase Freedom Unlimited is designed to provide cardholders with maximum value for their spending. Here are some key aspects of the program:

4.1 Cash Back Rewards

With the Chase Freedom Unlimited, you can earn unlimited 1.5% cash back on every purchase you make. This means that for every $1 you spend, you will earn $0.015 in cash back rewards.

4.2 Bonus Categories

In addition to the base cash back rewards, the Chase Freedom Unlimited offers bonus categories that change on a quarterly basis. These categories allow you to earn even more cash back on specific types of purchases.

4.3 Introductory Offers

The Chase Freedom Unlimited often comes with introductory offers, such as a 0% APR period on purchases and balance transfers for a certain number of months. This can be a great way to save on interest charges and consolidate debt.

5.Tips for Maximizing Your Rewards

To make the most of your Chase Freedom Unlimited card, consider the following tips:

5.1 Take Advantage of Bonus Categories

Keep an eye on the rotating bonus categories and make sure to maximize your spending during those periods. This will help you earn higher cash back rates on specific types of purchases.

5.2 Combine with Chase Ultimate Rewards

If you also hold a Chase Sapphire Preferred or Chase Sapphire Reserve card, you can combine your points and transfer them to travel partners for even greater value.

5.3 Redeeming Your Rewards

There are multiple ways to redeem your cash back rewards, including statement credits, direct deposits, and gift cards. Choose the option that best suits your needs and preferences.

6.Travel Benefits and Perks

One of the major advantages of the Chase Freedom Unlimited is its travel benefits and perks. Some notable features include:

6.1 Travel Insurance

The Chase Freedom Unlimited provides various travel insurance benefits, such as trip cancellation/interruption insurance, baggage delay insurance, and rental car insurance.

6.2 No Foreign Transaction Fees

When you use your Chase Freedom Unlimited card abroad, you won’t incur any foreign transaction fees. This can result in significant savings, especially for frequent international travelers.

6.3 Airport Lounge Access

Cardholders can enjoy complimentary access to over 1,200 airport lounges worldwide through the Chase Lounge Access program. This can enhance your travel experience and provide a peaceful oasis during layovers.

7.Managing Your Chase Freedom Unlimited Account

To effectively manage your Chase Freedom Unlimited account, consider the following:

7.1 Online Account Management

Chase provides an online platform where you can easily monitor your account activity, track your rewards, and make payments. Take advantage of these features to stay on top of your finances.

7.2 Setting Up AutoPay

To avoid late payment fees and maintain a good credit score, set up AutoPay for your Chase Freedom Unlimited card. This ensures that your payments are made on time, automatically.

7.3 Contacting Customer Service

If you have any questions, concerns, or need assistance with your Chase Freedom Unlimited card, don’t hesitate to contact the customer service department. They are available 24/7 and can provide you with the necessary support.

8.Frequently Asked Questions (FAQs)

8.1 How do I earn cash back with the Chase Freedom Unlimited?

To earn cash back, simply use your Chase Freedom Unlimited card for purchases. You will automatically receive 1.5% cash back on every transaction.

8.2 Can I use my Chase Freedom Unlimited card internationally?

Yes, the Chase Freedom Unlimited can be used internationally without incurring any foreign transaction fees, making it an excellent choice for travelers.

8.3 What is the minimum credit score required for approval?

While the specific credit score requirements may vary, a good credit score (typically above 670) increases your chances of approval for the Chase Freedom Unlimited.

8.4 Is there an annual fee for the Chase Freedom Unlimited?

No, the Chase Freedom Unlimited does not have an annual fee, making it a cost-effective option for cardholders.

8.5 How long does it take to receive my Chase Freedom Unlimited card?

Upon approval of your application, you can expect to receive your Chase Freedom Unlimited card within 7-10 business days.

Conclusion

The Chase Freedom Unlimited is a highly rewarding travel credit card that offers numerous benefits and a straightforward cash back program. With its flexible redemption options, travel perks, and no annual fee, it’s no wonder why many travelers choose this card. By understanding its features, maximizing rewards, and utilizing the travel benefits, you can make the most of your Chase Freedom Unlimited card and enjoy valuable savings on your travel expenses.