Table of Contents

- Introduction

- Understanding Covered Call Strategies

- Exploring the Nasdaq 100 Index

- Introducing the Global X Nasdaq 100 Covered Call ETF

- How Does the ETF Work?

- Benefits of Investing in the Global X Nasdaq 100 Covered Call ETF

- Risks to Consider

- Performance and Historical Returns

- Comparing the Global X Nasdaq 100 Covered Call ETF with Other Investment Options

- How to Invest in the Global X Nasdaq 100 Covered Call ETF

- Tax Considerations

- Conclusion

- FAQs

- FAQ 1: What is the Nasdaq 100 Index?

- FAQ 2: How does the Global X Nasdaq 100 Covered Call ETF generate income?

- FAQ 3: Can individuals invest in the Global X Nasdaq 100 Covered Call ETF?

- FAQ 4: Are there any management fees associated with the ETF?

- FAQ 5: What are the tax implications of investing in this ETF?

1. Introduction

In today’s dynamic and ever-evolving financial landscape, investors are constantly seeking opportunities to optimize their returns while managing risk effectively. The Global X Nasdaq 100 Covered Call ETF offers an innovative approach to achieving this goal. By harnessing the power of options strategies, this ETF aims to enhance portfolio returns while providing downside protection.

2. Understanding Covered Call Strategies

Before delving into the specifics of the Global X Nasdaq 100 Covered Call ETF, it’s essential to understand the concept of covered call strategies. A covered call is a popular options strategy employed by investors to generate income from their existing stock holdings. It involves selling call options on securities they already own, thereby earning premiums in exchange for potential upside gains.

3. Exploring the Nasdaq 100 Index

The Nasdaq 100 Index is a market-capitalization-weighted index that represents the performance of the 100 largest non-financial companies listed on the Nasdaq Stock Market. It is widely regarded as a benchmark for technology and growth stocks, including prominent companies like Apple, Microsoft, Amazon, and Facebook.

4. Introducing the Global X Nasdaq 100 Covered Call ETF

The Global X Nasdaq 100 Covered Call ETF (ticker symbol: QYLD) is designed to provide investors with exposure to the Nasdaq 100 Index while implementing a covered call strategy. The ETF seeks to generate income by selling monthly out-of-the-money call options on the Nasdaq 100 Index.

5. How Does the ETF Work?

The Global X Nasdaq 100 Covered Call ETF holds a portfolio of stocks that closely mirrors the composition of the Nasdaq 100 Index. The ETF then sells call options on a portion of its underlying securities. These call options provide the buyer with the right to purchase the ETF’s underlying shares at a predetermined price (strike price) within a specific timeframe.

6. Benefits of Investing in the Global X Nasdaq 100 Covered Call ETF

Investing in the Global X Nasdaq 100 Covered Call ETF offers several advantages to investors:

a. Enhanced Yield: By selling call options, the ETF generates additional income for investors, thereby enhancing the overall yield of their portfolio.

b. Downside Protection: The premiums earned from selling call options provide a cushion against potential downside risks, offering a measure of protection during market downturns.

c. Nasdaq 100 Exposure: Investors gain exposure to the Nasdaq 100 Index, enabling them to participate in the growth potential of leading technology and growth stocks.

7. Risks to Consider

While the Global X Nasdaq 100 Covered Call ETF presents compelling benefits, it’s crucial to acknowledge the associated risks:

a. Limited Upside Potential: When implementing a covered call strategy, the ETF’s upside potential may be constrained if the price of the underlying securities surpasses the strike price of the call options.

b. Market Volatility: The value of the ETF’s portfolio may fluctuate with changes in the Nasdaq 100 Index, market sentiment, and other economic factors. This volatility can impact the performance of the ETF.

c. Option Risk: Selling call options exposes the ETF to the risk of the market moving against it. If the price of the underlying securities increases significantly, the ETF may miss out on potential gains beyond the strike price.

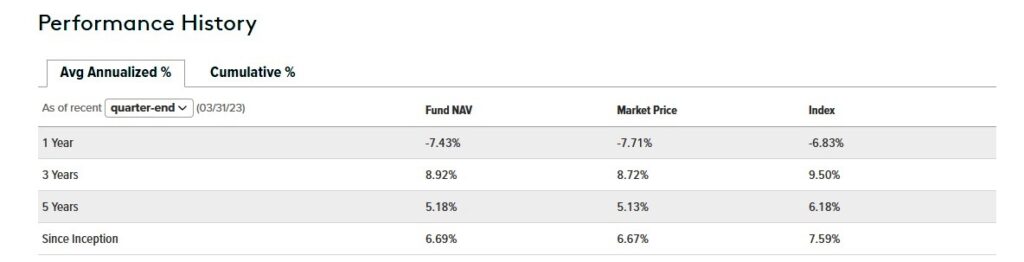

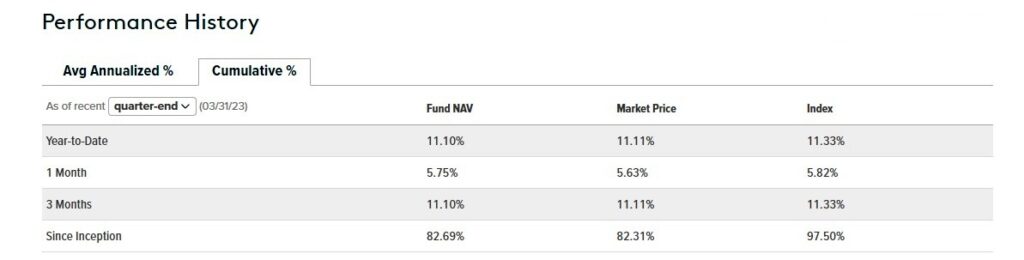

8. Performance and Historical Returns

The historical performance of the Global X Nasdaq 100 Covered Call ETF has demonstrated its potential to deliver attractive risk-adjusted returns. However, past performance is not indicative of future results. Investors should carefully analyze the ETF’s track record and consider their investment objectives before making a decision.

9. Comparing the Global X Nasdaq 100 Covered Call ETF with Other Investment Options

When considering investment options, it’s essential to evaluate the Global X Nasdaq 100 Covered Call ETF in the context of alternative choices. Comparisons can be made based on factors such as risk, return potential, expense ratios, and tax implications to determine which investment aligns best with an individual’s goals and preferences.

10. How to Invest in the Global X Nasdaq 100 Covered Call ETF

Investing in the Global X Nasdaq 100 Covered Call ETF is relatively straightforward. Individuals can open brokerage accounts with authorized financial institutions and purchase shares of the ETF using its ticker symbol (QYLD). It is advisable to consult with a financial advisor to ensure the investment aligns with one’s financial objectives and risk tolerance.

11. Tax Considerations

Investors should be aware of the tax implications associated with investing in the Global X Nasdaq 100 Covered Call ETF. Income generated from the sale of call options may be subject to taxation. It is advisable to consult with a tax professional to understand the specific tax rules and regulations applicable to one’s jurisdiction.

12. Conclusion

The Global X Nasdaq 100 Covered Call ETF provides investors with a unique opportunity to enhance their portfolio returns while managing risk effectively. By leveraging the power of options strategies, this ETF offers income generation potential and downside protection. However, investors should carefully assess the associated risks and conduct thorough due diligence before making investment decisions.

Frequently Asked Questions

FAQ 1: What is the Nasdaq 100 Index?

The Nasdaq 100 Index is a benchmark that represents the performance of the 100 largest non-financial companies listed on the Nasdaq Stock Market. It includes prominent technology and growth stocks.

FAQ 2: How does the Global X Nasdaq 100 Covered Call ETF generate income?

The Global X Nasdaq 100 Covered Call ETF generates income by selling call options on a portion of its underlying securities. The premiums received from the sale of these options contribute to the ETF’s income.

FAQ 3: Can individuals invest in the Global X Nasdaq 100 Covered Call ETF?

Yes, individuals can invest in the Global X Nasdaq 100 Covered Call ETF by purchasing shares through authorized brokerage accounts.

FAQ 4: Are there any management fees associated with the ETF?

Yes, like most ETFs, the Global X Nasdaq 100 Covered Call ETF charges management fees. It is essential to review the ETF’s prospectus for detailed fee information.

FAQ 5: What are the tax implications of investing in this ETF?

Income generated from the Global X Nasdaq 100 Covered Call ETF, such as premiums from selling call options, may be subject to taxation. It is advisable to consult with a tax professional to understand the specific tax rules applicable to your jurisdiction.