Introduction

In today’s digital age, self-directed trading has gained immense popularity among investors worldwide. With the advancements in technology and the rise of online trading platforms, individuals now have greater control over their investment decisions and can actively manage their portfolios. Ally Self-Directed Trading is one such platform that empowers investors to take charge of their financial future. In this article, we will delve into the world of Ally Self-Directed Trading, exploring its features, benefits, and how it revolutionizes the way investors approach the stock market.

Table of Contents

- What is Ally Self-Directed Trading?

- Getting Started with Ally Self-Directed Trading

- Opening an Account

- Depositing Funds

- Navigating the Platform

- Key Features of Ally Self-Directed Trading

- User-Friendly Interface

- Diverse Investment Options

- Real-Time Market Data and Research Tools

- Advanced Trading Order Types

- Mobile Accessibility

- Benefits of Ally Self-Directed Trading

- Lower Costs and Fees

- Control and Flexibility

- Education and Support

- Integration with Ally Bank Accounts

- Security and Privacy

- Tips for Successful Self-Directed Trading

- Setting Clear Financial Goals

- Conducting Thorough Research

- Implementing Risk Management Strategies

- Diversifying Your Portfolio

- Staying Informed and Adapting to Market Changes

- Conclusion

- FAQs

- Q1: Can I trade options on Ally Self-Directed Trading?

- Q2: Are there any account minimums required to open an Ally Self-Directed Trading account?

- Q3: How can I fund my Ally Self-Directed Trading account?

- Q4: Is my personal and financial information secure on the Ally Self-Directed Trading platform?

- Q5: Does Ally Self-Directed Trading provide any educational resources for beginner traders?

What is Ally Self-Directed Trading?

Ally Self-Directed Trading is an online trading platform that allows individuals to trade stocks, options, exchange-traded funds (ETFs), mutual funds, and other investment vehicles. It provides investors with a user-friendly interface and a wide range of tools and resources to make informed investment decisions. Whether you are a seasoned trader or a beginner, Ally Self-Directed Trading caters to investors of all levels, offering a seamless trading experience.

Getting Started with Ally Self-Directed Trading

1. Opening an Account

To begin your journey with Ally Self-Directed Trading, you need to open an account. The process is simple and can be completed online. You will need to provide some personal information, including your name, address, and social security number, to comply with regulatory requirements.

2. Depositing Funds

Once your account is open, you can deposit funds into your Ally Self-Directed Trading account. This can be done through various methods, such as electronic funds transfer, wire transfer, or check deposit. Ally ensures that your funds are secure and readily available for trading.

3. Navigating the Platform

Ally Self-Directed Trading offers an intuitive and user-friendly platform that allows investors to easily navigate through various sections. You can access real-time market data, track your portfolio performance, execute trades, and explore research tools to stay informed about the latest market trends.

Key Features of Ally Self-Directed Trading

1. User-Friendly Interface

Ally Self-Directed Trading is designed with simplicity in mind. The platform offers a clean and intuitive interface, making it easy for investors to find the information they need and execute trades efficiently.

2. Diverse Investment Options

With Ally Self-Directed Trading, investors have access to a wide range of investment options. From stocks and ETFs to bonds and mutual funds, the platform provides ample choices for investors to diversify their portfolios according to their investment goals and risk tolerance.

3. Real-Time Market Data and Research Tools

Staying informed about market trends is crucial for successful trading. Ally Self-Directed Trading equips investors with real-time market data, news updates, and research tools to help them make informed investment decisions.

4. Advanced Trading Order Types

Ally Self-Directed Trading offers advanced trading order types, such as limit orders, stop orders, and trailing stop orders. These features allow investors to set specific price levels for buying or selling securities, giving them greater control over their trades.

5. Mobile Accessibility

In today’s fast-paced world, having access to your investments on the go is essential. Ally Self-Directed Trading provides a mobile app that enables investors to monitor their portfolios, execute trades, and stay connected to the market anytime, anywhere.

Benefits of Ally Self-Directed Trading

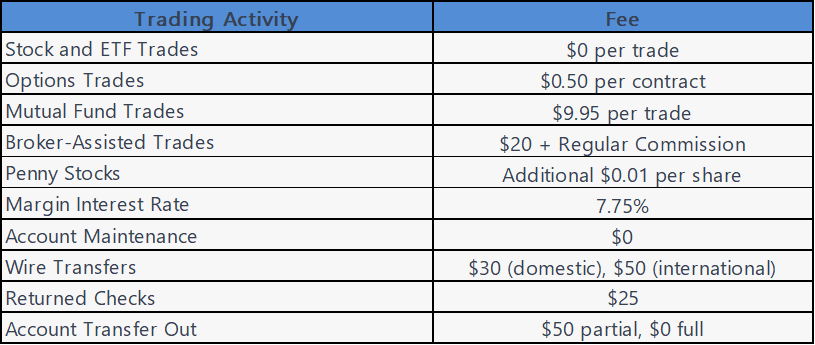

1. Lower Costs and Fees

Ally Self-Directed Trading offers competitive pricing and low fees, allowing investors to keep more of their investment returns. The platform aims to provide value to its users by minimizing costs associated with trading and account maintenance.

*Please note that these fees are subject to change and it’s always recommended to refer to the official Ally Self-Directed Trading website for the most up-to-date fee structure.

2. Control and Flexibility

With Ally Self-Directed Trading, investors have full control over their investment decisions. They can execute trades as per their own research and strategies, enabling them to capitalize on market opportunities and react swiftly to changing market conditions.

3. Education and Support

Ally Self-Directed Trading understands the importance of investor education. The platform provides a wealth of educational resources, including articles, videos, and webinars, to help investors enhance their trading skills and stay updated with market trends.

4. Integration with Ally Bank Accounts

For customers who already have Ally Bank accounts, Ally Self-Directed Trading offers seamless integration. Investors can easily transfer funds between their bank accounts and trading accounts, streamlining their financial management.

5. Security and Privacy

Ally takes the security and privacy of its customers seriously. The platform employs robust security measures, such as encryption and multi-factor authentication, to protect user data and ensure a safe trading environment.

Tips for Successful Self-Directed Trading

- Setting Clear Financial Goals: Clearly define your financial goals and investment objectives before entering the market. This will help you stay focused and make informed decisions aligned with your long-term aspirations.

- Conducting Thorough Research: Stay informed about the companies and industries you invest in. Conduct thorough research, analyze financial statements, and consider both qualitative and quantitative factors before making investment decisions.

- Implementing Risk Management Strategies: Assess your risk tolerance and develop a risk management strategy that aligns with your investment goals. Diversify your portfolio, set stop-loss orders, and regularly review and adjust your holdings as needed.

- Diversifying Your Portfolio: Spread your investments across different asset classes and sectors to mitigate risk. Diversification can help protect your portfolio from the impact of a single investment or market event.

- Staying Informed and Adapting to Market Changes: Stay updated with market news, economic indicators, and company-specific developments. Be prepared to adapt your investment strategy based on changing market conditions and opportunities.

Conclusion

Ally Self-Directed Trading provides investors with a powerful platform to take control of their financial future. With its user-friendly interface, diverse investment options, real-time market data, and competitive pricing, Ally empowers individuals to make informed investment decisions and actively manage their portfolios. Whether you are a seasoned trader or just starting your investment journey, Ally Self-Directed Trading offers the tools and resources to support your success in the stock market.

Frequently Asked Questions

Q1: Can I trade options on Ally Self-Directed Trading?

Yes, Ally Self-Directed Trading allows you to trade options. It provides options trading capabilities for investors seeking to explore more advanced trading strategies.

Q2: Are there any account minimums required to open an Ally Self-Directed Trading account?

Ally Self-Directed Trading does not have any account minimums, making it accessible to investors with varying levels of capital.

Q3: How can I fund my Ally Self-Directed Trading account?

You can fund your Ally Self-Directed Trading account through electronic funds transfer, wire transfer, or check deposit. Ally provides multiple options to conveniently deposit funds into your trading account.

Q4: Is my personal and financial information secure on the Ally Self-Directed Trading platform?

Yes, Ally takes the security and privacy of its customers seriously. The platform employs robust security measures to protect your personal and financial information, ensuring a secure trading environment.

Q5: Does Ally Self-Directed Trading provide any educational resources for beginner traders?

Yes, Ally Self-Directed Trading offers a range of educational resources tailored for beginner traders. These resources include articles, videos, webinars, and other tools to help investors enhance their trading knowledge and skills.

-

33-year-old mortician doesn’t fear death and is ‘wildly happy’ earning $87,000 a year: I haven’t ‘gone home sad a single day’

The first time Victor M. Sweeney observed an embalming, it was for an 18-year-old woman who had died in a car crash just before her high school graduation. At the …

-

All sides claim victory in Georgia election as exit polls give different results

Supporters of the Georgian Dream party celebrate at the party’s headquarters after the announcement of exit poll results in parliamentary elections, in Tbilisi, Georgia October 26, 2024.. Irakli Gedenidze | …

-

Biden says Elon Musk was an ‘illegal worker’ when he began U.S. career

Joe Biden, left, and Elon Musk. Evelyn Hockstein | Reuters; Andrew Harrer | Bloomberg | Getty Images. President Joe Biden called out Tesla and SpaceX CEO Elon Musk, now a …

-

39-year-old makes about $18,000 a month in passive income without a college degree: ‘I work only 4 hours a day’

After dropping out of college in 2007, Amy Landino started a side hustle creating videos and doing social media. Ultimately she was able to quit her day job.

-

39-year-old makes about $18,000 a month in passive income without a college degree: ‘I work only 4 hours a day’

After dropping out of college in 2007, Amy Landino started a side hustle creating videos and doing social media. Ultimately she was able to quit her day job.

-

The Washington Post is in deep turmoil as Bezos remains silent on non-endorsement

New York CNN —. One day after The Washington Post announced it would not endorse a presidential candidate in this year’s election or in the future, its billionaire owner remains …