Introduction

In today’s fast-paced world, the healthcare industry plays a pivotal role in ensuring the well-being of individuals and communities. Investors seeking opportunities in this sector often turn to mutual funds like Fidelity Select Health Care Portfolio (FSPHX) to capitalize on the growth potential and stability offered by healthcare companies. This article delves into the Fidelity Select Health Care Portfolio, exploring its investment strategy, key holdings, performance history, and benefits for investors.

Table of Contents

- Understanding Fidelity Select Health Care Portfolio

- 1.1 An Overview of Mutual Funds

- 1.2 Fidelity Select Health Care Portfolio: An Introduction

- Investment Strategy of FSPHX

- 2.1 Focus on Healthcare Companies

- 2.2 Diversification and Risk Management

- Key Holdings and Sectors

- 3.1 Pharmaceutical Companies

- 3.2 Biotechnology Firms

- 3.3 Medical Device Manufacturers

- 3.4 Healthcare Services Providers

- Performance Analysis

- 4.1 Historical Returns and Growth

- 4.2 Comparison with Benchmark Indices

- Benefits of Investing in FSPHX

- 5.1 Exposure to a High-Potential Sector

- 5.2 Professional Fund Management

- 5.3 Diversification and Risk Mitigation

- FAQs

- 6.1 What is the minimum investment required for Fidelity Select Health Care Portfolio?

- 6.2 Can I invest in FSPHX through an individual retirement account (IRA)?

- 6.3 How often does FSPHX rebalance its holdings?

- 6.4 Does Fidelity Select Health Care Portfolio pay dividends?

- 6.5 What are the fees associated with investing in FSPHX?

- Conclusion

- FAQs (Unique)

1. Understanding Fidelity Select Health Care Portfolio

1.1 An Overview of Mutual Funds

Before delving into Fidelity Select Health Care Portfolio, it’s essential to understand the concept of mutual funds. Mutual funds are investment vehicles that pool money from multiple investors to create a diversified portfolio managed by professional fund managers. They offer individuals with varying investment goals and risk tolerances an opportunity to access the financial markets efficiently.

1.2 Fidelity Select Health Care Portfolio: An Introduction

Fidelity Select Health Care Portfolio (FSPHX) is one such mutual fund offered by Fidelity Investments, one of the world’s largest investment management firms. FSPHX specifically focuses on investments in the healthcare sector, aiming to generate long-term capital appreciation by investing in companies associated with pharmaceuticals, biotechnology, medical devices, healthcare services, and related industries.

2. Investment Strategy of FSPHX

2.1 Focus on Healthcare Companies

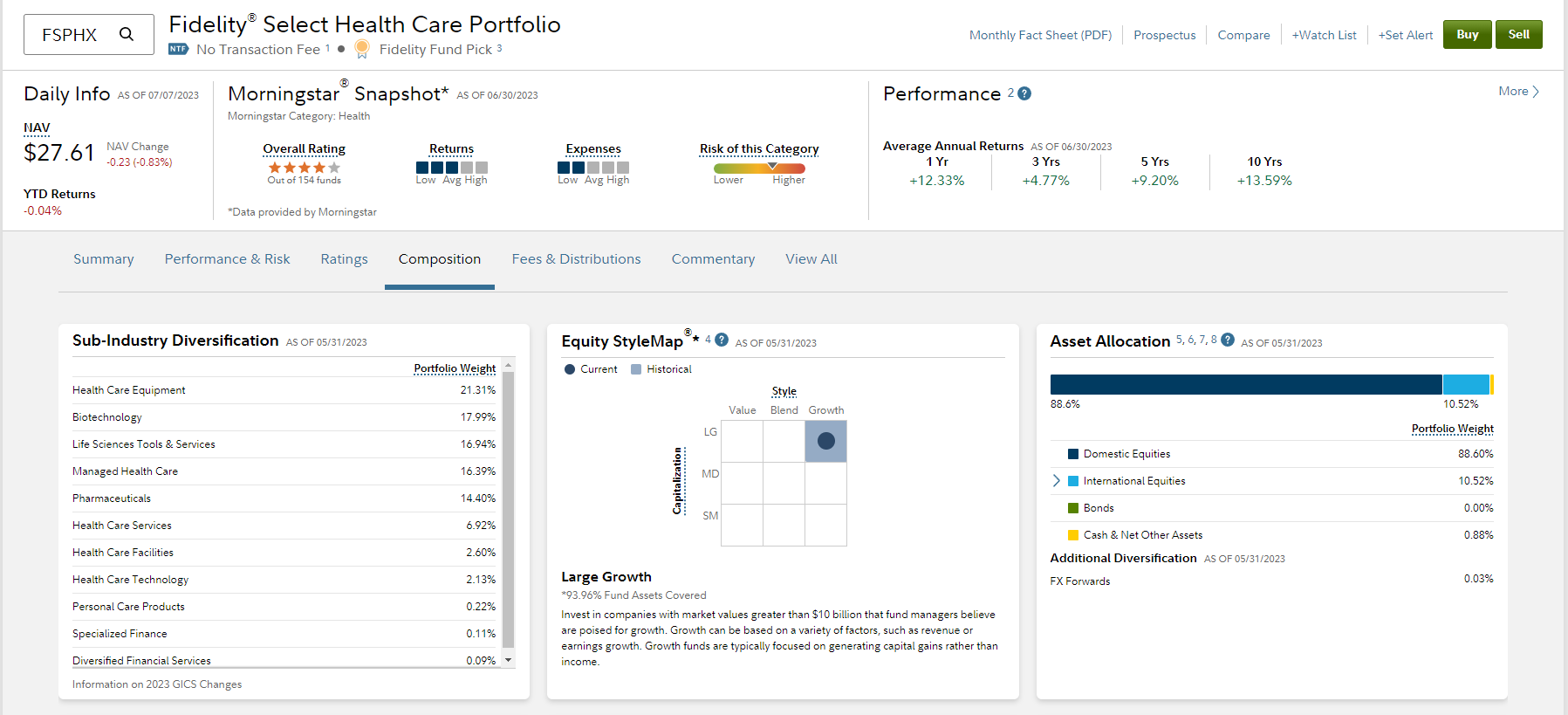

Fidelity Select Health Care Portfolio follows an active management strategy, capitalizing on the expertise of its fund managers to identify and invest in promising healthcare companies. The fund managers conduct thorough research and analysis to select companies with strong growth potential, robust financials, and competitive advantages within their respective segments.

2.2 Diversification and Risk Management

Diversification is a key aspect of FSPHX’s investment strategy. By investing in a wide range of healthcare companies across various subsectors, the fund aims to reduce concentration risk and potential volatility. Additionally, the fund managers continuously monitor and assess market trends, company-specific risks, and regulatory changes to make informed investment decisions.

3. Key Holdings and Sectors

3.1 Pharmaceutical Companies

Pharmaceutical companies represent a significant portion of FSPHX’s holdings. These companies engage in the research, development, and production of drugs and medications to address various medical conditions. FSPHX invests in established pharmaceutical giants as well as promising small-to-mid-cap companies with innovative drug pipelines.

3.2 Biotechnology Firms

Biotechnology firms leverage biological processes and organisms to develop new medical therapies and treatments. FSPHX identifies and invests in biotech companies involved in groundbreaking research, clinical trials, and drug discoveries. These companies often offer high growth potential but also come with inherent risks due to the nature of their business.

3.3 Medical Device Manufacturers

Medical device manufacturers play a crucial role in providing innovative technologies and devices to the healthcare industry. FSPHX includes companies involved in the development and production of medical instruments, diagnostic tools, imaging equipment, and other healthcare-related devices.

3.4 Healthcare Services Providers

The healthcare services sector encompasses a wide range of companies involved in delivering medical care, hospital management, healthcare IT services, and more. FSPHX identifies companies with solid business models and competitive advantages within this sector, offering investors exposure to the growing demand for quality healthcare services.

4. Performance Analysis

4.1 Historical Returns and Growth

Fidelity Select Health Care Portfolio has a strong performance history, delivering consistent returns over the years. However, it’s important to note that past performance does not guarantee future results. Investors should carefully evaluate their investment goals and risk tolerance before making investment decisions.

4.2 Comparison with Benchmark Indices

Benchmark indices, such as the S&P 500 Healthcare Index or the NASDAQ Biotechnology Index, can provide insights into the fund’s performance relative to the broader market. Investors can compare FSPHX’s returns and risk-adjusted measures against these indices to assess its performance within the healthcare sector.

5. Benefits of Investing in FSPHX

5.1 Exposure to a High-Potential Sector

The healthcare sector offers immense growth potential due to factors such as an aging population, advancements in medical technology, and increasing healthcare expenditure. Investing in Fidelity Select Health Care Portfolio allows individuals to participate in this growth and potentially benefit from the sector’s long-term prospects.

5.2 Professional Fund Management

FSPHX is managed by a team of experienced professionals who specialize in healthcare investments. Their expertise and research capabilities enable them to identify promising companies and navigate the complexities of the healthcare sector, providing investors with the advantage of professional fund management.

5.3 Diversification and Risk Mitigation

By investing in FSPHX, investors gain exposure to a diversified portfolio of healthcare companies across various subsectors. This diversification helps mitigate risks associated with individual stock holdings, as the performance of one company is less likely to significantly impact the overall portfolio.

6. Frequently Asked Questions

6.1 What is the minimum investment required for Fidelity Select Health Care Portfolio?

The minimum investment requirement for Fidelity Select Health Care Portfolio is typically disclosed by the fund provider. Investors should refer to the official documentation or consult with their financial advisors to determine the specific minimum investment amount.

6.2 Can I invest in FSPHX through an individual retirement account (IRA)?

Yes, Fidelity Select Health Care Portfolio can be purchased through an individual retirement account (IRA). Investors seeking to include this fund in their IRA should consult with their IRA custodian or financial advisor to ensure compliance with IRS regulations.

6.3 How often does FSPHX rebalance its holdings?

The frequency of portfolio rebalancing can vary based on market conditions and the fund manager’s strategy. Fidelity Select Health Care Portfolio may rebalance its holdings periodically to maintain the desired asset allocation and capitalize on new investment opportunities.

6.4 Does Fidelity Select Health Care Portfolio pay dividends?

Yes, Fidelity Select Health Care Portfolio has the potential to pay dividends. The fund’s dividend distribution is typically influenced by the dividend policies of the underlying healthcare companies in which it invests. Investors should review the fund’s prospectus for specific details on dividend payments.

6.5 What are the fees associated with investing in FSPHX?

Fidelity Select Health Care Portfolio may charge various fees, including management fees, administrative expenses, and potential sales loads. Investors should review the fund’s prospectus and consult with their financial advisors to understand the fee structure and associated costs before investing.

7. Conclusion

Fidelity Select Health Care Portfolio (FSPHX) offers investors an opportunity to participate in the growth potential of the healthcare sector. With its focused investment strategy, diversified portfolio, and professional fund management, FSPHX aims to deliver long-term capital appreciation. However, investors should carefully evaluate their investment objectives, risk tolerance, and consult with their financial advisors before making investment decisions.

Frequently Asked Questions (Unique)

Can I redeem my investment in Fidelity Select Health Care Portfolio at any time?

Yes, Fidelity Select Health Care Portfolio allows investors to redeem their investments at any time, subject to the terms and conditions outlined by the fund provider. Investors should refer to the fund’s prospectus for specific details regarding redemption procedures and any associated fees or restrictions.

What is the expense ratio of Fidelity Select Health Care Portfolio?

The expense ratio represents the annual fee charged by the mutual fund to cover its operating expenses. The specific expense ratio for Fidelity Select Health Care Portfolio can be found in the fund’s prospectus. It is important for investors to consider expense ratios when evaluating the overall cost of investing in the fund.

Can I make automatic contributions to Fidelity Select Health Care Portfolio?

Fidelity Select Health Care Portfolio may offer automatic investment plans, such as systematic investment or automatic payroll deductions, to facilitate regular contributions. Investors interested in setting up automatic contributions should contact Fidelity Investments or consult with their financial advisors to explore the available options.

How does Fidelity Select Health Care Portfolio manage risk?

FSPHX employs various risk management techniques to mitigate potential risks. This includes diversification across healthcare subsectors, active monitoring of market trends and regulatory changes, and in-depth research conducted by experienced fund managers. It is important to note that all investments come with inherent risks, and investors should carefully consider their risk tolerance before investing.

What is the historical performance of Fidelity Select Health Care Portfolio during economic downturns?

Historical performance during economic downturns can vary, and it is crucial to note that past performance does not guarantee future results. During economic downturns, the healthcare sector may experience unique dynamics that can impact the performance of Fidelity Select Health Care Portfolio. Investors should carefully assess their investment goals and consult with their financial advisors to understand the potential risks and rewards associated with investing in FSPHX.