Introduction

In the dynamic realm of finance, the quest for secure and adaptable investment avenues assumes paramount importance. One such avenue that has been garnering increasing attention is the No Penalty Certificate of Deposit (CD) offered by the esteemed institution, Ally Bank. In this all-encompassing manual, we shall embark on a comprehensive journey into the intricacies of this groundbreaking financial instrument. From grasping the essence of the No Penalty CD to delving into its array of advantageous features, our expedition shall leave no stone unturned. Thus, let us commence this voyage of financial enlightenment in the company of Ally Bank and its innovative No Penalty CD.

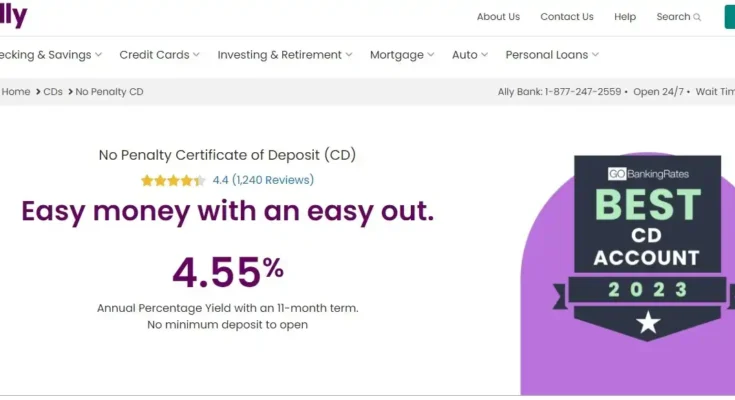

Easy money with an easy out.

4.55%

Annual Percentage Yield with an 11-month term.

No minimum deposit to open

Decoding the No Penalty Certificate of Deposit

The No Penalty CD presents itself as a distinctive financial mechanism that bridges the chasm between traditional certificates of deposit and more fluid savings accounts. Unlike conventional CDs, which levy penalties for premature withdrawals, the No Penalty CD extends investors the privilege of accessing their funds sans any punitive charges. This proposition presents a tantalizing prospect for those in pursuit of equilibrium between augmented interest rates and liquidity.

| Seriously. No penalty. There’s no minimum deposit required to open your account, and you can withdraw your full balance and interest any time after the first 6 days of funding your CD. Plus, we don’t charge monthly maintenance fees. | Earn more with competitive rates. Get the best rate we offer for your CD term with the Ally Ten Day Best Rate Guarantee and grow your money with interest compounded daily. | Reward you when you renew. We’re currently giving a 0.05% Loyalty Reward when you renew your CD to any CD with us. Check back 30 days before your CD matures to see what the reward is at that time. |

The Ally Bank Distinction

A Revelation of the Ally Bank No Penalty CD

Ally Bank has unmistakably positioned itself as a trailblazing entity within the financial arena, bestowing upon its patrons innovative solutions to augment and safeguard their wealth. The No Penalty CD, offered by Ally Bank, stands as a testimony to this unwavering commitment.

| Ally Bank don’t charge any maintenance fees for your Ally Bank CD. | You will not be charged a penalty for early withdrawal. You can withdraw your full balance and interest any time after the first 6 days following the date you funded the account. |

You have a 10-day grace period starting on your maturity date to:

- Change the term

- Make additional deposits or withdraw funds

- Close the CD

After your 10-day grace period, your CD will automatically renew into the same term if you don’t make any changes. There are Select CDs that don’t renew into the same term, instead they renew into the term defined when the CD is open.

No Penalty CD – 11-month term that lets you withdraw all your money any time after the first 6 days following the date you funded the account, and keep the interest earned with no penalties.

Primary Attributes and Advantages

Flexibility: In the realm of the Ally Bank No Penalty CD, the investor is granted the liberty to access their capital devoid of any retribution post a succinct holding duration. Ergo, one’s monetary assets remain unshackled, thereby conferring financial autonomy.

Competitive Interest Rates: Ally Bank extends a collection of competitive interest rates that rival the conventional CDs. This signifies that one can revel in the advantages of amplified returns without relinquishing the attribute of liquidity.

Security: The bastion of security that Ally Bank epitomizes is universally acknowledged. The investor’s financial commitment is fortified by FDIC insurance up to the maximal threshold, ensuring an untroubled state of mind.

Streamlined Account Management: The management of one’s No Penalty CD is an endeavor devoid of complications, thanks to the user-friendly digital banking platform pioneered by Ally Bank. The monitoring of investment progression and the capability to access funds at one’s discretion are seamlessly facilitated.

Assessing the Suitability of the No Penalty CD

The appropriateness of integrating a No Penalty CD into one’s financial strategy hinges upon one’s fiscal objectives and the tolerance for risk. The following scenarios merit consideration:

Emergency Reserve: For those desiring to preserve a financial safety net while concurrently accruing superior interest compared to conventional savings accounts, the No Penalty CD could potentially emerge as a judicious selection.

Near-Term Objectives: Individuals with imminent financial obligations or investment ventures, who remain disinclined to subject their resources to the rigidity of traditional CDs, shall find solace in the No Penalty CD, encapsulating an optimal equilibrium of expansion and accessibility.

Portfolio Diversification: The assimilation of a No Penalty CD into one’s investment portfolio can yield diversification and risk alleviation, particularly when juxtaposed against the volatilities inherent in alternative investment avenues.

How to Get Started

Getting started with an Ally Bank No Penalty CD is straightforward:

- Visit the www.ally.com and navigate to the “CDs” section.

- Select the No Penalty CD option and review the terms, interest rates, and account details.

- Open an account online by providing the necessary information and funding your CD.

- Start watching your money grow while retaining the option to access it penalty-free.

In Conclusion

The No Penalty CD promulgated by Ally Bank embodies innovation, adaptability, and augmentation within the realm of finance. By amalgamating the security characteristic of traditional CDs with the pliancy akin to a savings account, this financial tool endows investors with the means to optimize their fiscal expedition. Whether one’s objectives encompass erecting a financial buffer, accumulating resources for immediate ambitions, or fostering diversification within one’s investment spectrum, the No Penalty CD emerges as a compelling and sagacious recourse.