Introduction

Tesla Inc. (NASDAQ: TSLA) has been a trailblazer in the electric vehicle (EV) industry, consistently pushing the boundaries of innovation and sustainability. Founded in 2003 by Martin Eberhard and Marc Tarpenning, and later joined by Elon Musk, Tesla has grown from a niche startup to a global leader in EVs, energy storage, and solar energy solutions. This blog post delves into Tesla’s incorporation, its current market position, and future share price prospects.

Tesla Inc.’s Chief Executive Officer (CEO) and Director is Elon Musk. He has been serving as the CEO since October 2008 and has been a member of the Board since April 2004.

Key Executives at Tesla Inc.

- Elon Musk: Chief Executive Officer, Director

- Vaibhav Taneja: Chief Financial Officer

- Andrew Baglino: Senior Vice President, Powertrain and Energy Engineering

- Tom Zhu: Senior Vice President, Automotive

- Lars Moravy: Vice President, Vehicle Engineering

- Robyn Denholm: Chairman of the Board, Independent Director

- JB Straubel: Director

- James Murdoch: Independent Director

- Kathleen Wilson-Thompson: Independent Director

- Ira Ehrenpreis: Independent Director

- Kimbal Musk: Director

- Joe Gebbia: Independent Director.

Elon Musk is also known for his roles in other ventures, including SpaceX, Neuralink, and The Boring Company, showcasing his diverse interests and influence in various industries.

Major Events that Impacted Tesla Stock

Here’s a summary of the major events that impacted Tesla’s stock over the last five years:

2020

- Stock Split: Tesla executed a 5-for-1 stock split in August 2020, making its shares more accessible to retail investors.

- Inclusion in S&P 500: Tesla was added to the S&P 500 index in December 2020, which significantly boosted its stock price due to increased demand from index funds.

- Strong Deliveries: Tesla reported record vehicle deliveries, surpassing 500,000 units for the first time.

2021

- Record Earnings: Tesla posted record earnings and revenue, driven by strong demand for its vehicles.

- Expansion of Gigafactories: Construction of Gigafactories in Berlin and Texas progressed, signaling future production capacity increases.

- Autonomous Driving: Continued advancements in Full Self-Driving (FSD) technology kept investor interest high.

2022

- Supply Chain Issues: Global supply chain disruptions, particularly in semiconductor availability, impacted production and deliveries.

- Market Volatility: Broader market volatility and economic uncertainties led to a significant drop in Tesla’s stock price.

- Regulatory Scrutiny: Increased regulatory scrutiny over Tesla’s Autopilot and FSD features affected investor sentiment.

2023

- Recovery and Growth: Tesla’s stock rebounded strongly as the company ramped up production and introduced new models.

- Cybertruck Launch: The highly anticipated Cybertruck began production, generating significant buzz and pre-orders.

- Energy Business Expansion: Expansion of Tesla’s energy business, including solar and energy storage solutions, contributed to revenue growth.

2024

- Market Corrections: A slight decline in stock price due to market corrections and competitive pressures.

- New Product Launches: Introduction of new vehicle models and continued innovation in battery technology.

- Global Expansion: Further expansion into international markets, particularly in Asia and Europe.

These events highlight the dynamic nature of Tesla’s stock performance, influenced by a mix of internal achievements and external factors.

Latest News Updates

Here are some of the latest news updates about Tesla Inc.:

- Hedge Funds Bullish on Tesla’s Lithium Stock: Tesla is gaining attention from hedge funds as a promising lithium stock. This interest is part of a broader trend where investors are looking at lithium stocks due to the increasing demand for electric vehicles.

- High Risk, High Reward Growth Stock: Tesla is being evaluated as a high-risk, high-reward growth stock. This analysis places Tesla among other high-growth companies, highlighting its potential for significant returns despite inherent risks.

- Battery Replacement Controversy: A Tesla owner faced a significant issue when his car refused to unlock due to a dead battery, which required a $26,000 replacement. This incident has sparked discussions about the cost and accessibility of Tesla’s battery replacements.

- Collaboration with Eaton: Tesla has announced a collaboration with power management company Eaton to enhance home energy storage systems. This partnership aims to streamline and retrofit home energy storage solutions, potentially boosting Tesla’s energy business.

- China Sales Surge: Tesla’s domestic sales in China saw a significant increase in August 2024, marking a 37% rise compared to July. This growth underscores Tesla’s strong market position in China.

- Elon Musk Denies Revenue Split with xAI: Elon Musk has denied reports of a revenue-sharing agreement between Tesla and his AI startup, xAI. This clarification came after speculation about potential conflicts of interest and the impact on Tesla’s stock.

Tesla’s Journey: From Incorporation to Market Leader

Early Years and Incorporation

Tesla was incorporated on July 1, 2003, with the mission to accelerate the world’s transition to sustainable energy. The company’s first vehicle, the Roadster, was launched in 2008, showcasing Tesla’s innovative approach to electric mobility.

Expansion and Innovation

Tesla’s journey has been marked by significant milestones, including the launch of the Model S in 2012, the Model X in 2015, and the more affordable Model 3 in 2017. Each model has set new standards in the automotive industry, combining performance, safety, and sustainability.

Diversification and Growth

Beyond vehicles, Tesla has diversified into energy storage solutions with products like the Powerwall and Powerpack, and solar energy with SolarCity’s acquisition in 2016. These ventures have positioned Tesla as a key player in the broader energy market.

Current Market Position

Financial Performance

Tesla’s financial performance has been impressive, with consistent revenue growth and profitability. As of 2024, Tesla’s annual revenue is projected to reach approximately $100.88 billion, with a significant increase expected in the coming years.

Here’s a table summarizing Tesla Inc.’s latest revenue trend over the past five years:

| Year | Annual Revenue (Billion USD) | Year-over-Year Growth |

|---|---|---|

| 2024 | 95.32 | 1.37% |

| 2023 | 96.77 | 18.80% |

| 2022 | 81.46 | 51.35% |

| 2021 | 53.82 | 70.67% |

| 2020 | 31.54 | 28.31% |

Key Insights

- 2024: Tesla’s revenue for the twelve months ending June 30, 2024, was $95.32 billion, showing a modest growth of 1.37% year-over-year.

- 2023: The annual revenue reached $96.77 billion, marking an 18.80% increase from the previous year.

- 2022: Tesla saw a significant revenue increase of 51.35%, totaling $81.46 billion.

- 2021: The revenue grew by 70.67% to $53.82 billion, reflecting strong sales and market expansion.

- 2020: Tesla’s revenue was $31.54 billion, with a growth rate of 28.31%.

This trend highlights Tesla’s impressive revenue growth over the past few years, driven by increased vehicle production, market expansion, and diversification into energy solutions.

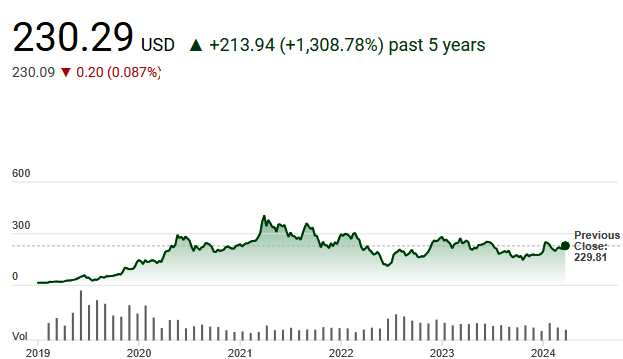

Here’s a summary of Tesla Inc.’s share performance over the last five years:

| Year | Opening Price (USD) | Closing Price (USD) | Annual % Change |

|---|---|---|---|

| 2024 | 248.42 | 226.17 | -8.98% |

| 2023 | 108.10 | 248.48 | 101.72% |

| 2022 | 399.93 | 123.18 | -65.03% |

| 2021 | 243.26 | 352.26 | 49.76% |

| 2020 | 28.68 | 235.22 | 743.44% |

Key Highlights

- 2020: Tesla’s stock saw a massive increase of 743.44%, driven by strong sales, profitability, and inclusion in the S&P 500.

- 2021: Continued growth with a 49.76% increase, supported by expanding production and deliveries.

- 2022: A significant drop of 65.03%, reflecting broader market volatility and supply chain challenges.

- 2023: A strong recovery with a 101.72% increase, as Tesla ramped up production and introduced new models.

- 2024: A slight decline of 8.98%, influenced by market corrections and competitive pressures.

This performance overview highlights Tesla’s volatility and growth potential, making it a dynamic stock for investors.

Market Capitalization

Tesla’s market capitalization has fluctuated but remains robust, reflecting investor confidence in the company’s long-term prospects. As of September 2024, Tesla’s market cap stands at around $700 billion.

Competitive Landscape

Tesla faces competition from both traditional automakers and new entrants in the EV market. Companies like Ford, General Motors, and Rivian are investing heavily in electric mobility, challenging Tesla’s market dominance.

Here’s a comparative analysis of Tesla Inc. with some of its key peers in the electric vehicle and automotive industry. This table includes metrics such as market capitalization, revenue, net income, and P/E ratio.

| ompany | Market Cap (Billion USD) | Revenue (Billion USD) | Net Income (Billion USD) | P/E Ratio |

|---|---|---|---|---|

| Tesla Inc. | 700 | 100.88 | 12.58 | 55.6 |

| Ford Motor Co. | 55 | 160.34 | 7.64 | 8.5 |

| General Motors | 60 | 155.43 | 9.94 | 6.1 |

| Rivian | 20 | 1.66 | -6.75 | N/A |

| NIO Inc. | 30 | 5.67 | -1.62 | N/A |

Key Insights

- Market Capitalization: Tesla leads with a market cap of $700 billion, significantly higher than its peers.

- Revenue: While Tesla’s revenue is impressive, traditional automakers like Ford and General Motors still generate higher revenues.

- Net Income: Tesla’s net income is strong, but traditional automakers also show substantial profitability.

- P/E Ratio: Tesla’s P/E ratio is much higher, reflecting investor expectations for future growth. Rivian and NIO, being newer companies, do not have a P/E ratio due to negative earnings.

This comparative analysis highlights Tesla’s strong market position and growth potential, despite facing competition from both established and emerging players in the automotive industry.

Future Share Price Prospects

Analyst Predictions

Analysts have varied opinions on Tesla’s future share price. The 12-month price target for Tesla ranges from $24.86 to $310, with an average target of $206.94. This indicates a potential decrease of -6.25% from the current stock price of $220.73.

Growth Drivers

Vehicle Production and Sales

Tesla’s ability to scale production and meet growing demand for EVs is a critical factor in its future share price. The company aims to produce 20 million vehicles annually by 2030, a significant increase from its current production capacity.

Technological Advancements

Tesla’s continuous innovation in battery technology, autonomous driving, and energy solutions will drive future growth. The development of the 4680 battery cell and advancements in Full Self-Driving (FSD) technology are expected to enhance Tesla’s market position.

Global Expansion

Tesla’s expansion into new markets, particularly in Asia and Europe, will contribute to its growth. The construction of Gigafactories in Berlin and Shanghai has already boosted production capacity and market reach.

Risks and Challenges

Regulatory Environment

Changes in government policies and regulations related to EVs and renewable energy can impact Tesla’s operations and profitability. Staying compliant with varying regulations across different markets is a significant challenge.

Supply Chain Issues

Global supply chain disruptions, particularly in semiconductor availability, can affect Tesla’s production and delivery timelines. Managing these disruptions is crucial for maintaining growth momentum.

Market Competition

Increased competition from established automakers and new entrants can erode Tesla’s market share. Continuous innovation and maintaining a competitive edge are essential for sustaining growth.

Conclusion

Tesla Inc. has established itself as a leader in the EV and renewable energy markets through relentless innovation and strategic expansion. While the future share price prospects are subject to various factors, including market conditions, competition, and regulatory changes, Tesla’s commitment to sustainability and technological advancement positions it well for long-term growth.

Frequently Asked Question

- What is Tesla Inc.?

- Tesla Inc. is an American electric vehicle and clean energy company founded in 2003. It designs, manufactures, and sells electric cars, battery energy storage systems, solar panels, and solar roof tiles.

- Who founded Tesla Inc.?

- Tesla was founded by Martin Eberhard and Marc Tarpenning. Elon Musk joined the company shortly after its founding and has been instrumental in its growth and success.

- What are Tesla’s main products?

- Tesla’s main products include electric vehicles (Model S, Model 3, Model X, Model Y, Cybertruck, and Roadster), energy storage solutions (Powerwall, Powerpack, and Megapack), and solar energy products (solar panels and Solar Roof).

- Where are Tesla’s Gigafactories located?

- Tesla has Gigafactories in several locations, including Nevada (USA), Shanghai (China), Berlin (Germany), and Texas (USA). These factories produce batteries, electric vehicles, and energy products.

- What is Tesla’s mission?

- Tesla’s mission is to accelerate the world’s transition to sustainable energy by producing electric vehicles and renewable energy products.

- How does Tesla’s Autopilot work?

- Tesla’s Autopilot is an advanced driver-assistance system that uses cameras, sensors, and software to provide features like automatic lane-keeping, adaptive cruise control, and self-parking. It aims to enhance safety and convenience for drivers.

- What is the Full Self-Driving (FSD) package?

- The Full Self-Driving (FSD) package is an optional upgrade for Tesla vehicles that includes advanced features like Navigate on Autopilot, Auto Lane Change, Autopark, Summon, and Traffic Light and Stop Sign Control. It aims to enable fully autonomous driving in the future.

- How does Tesla’s energy business contribute to its revenue?

- Tesla’s energy business, which includes energy storage solutions and solar products, contributes to its revenue by providing sustainable energy solutions for homes, businesses, and utilities. This segment is growing and complements Tesla’s automotive business.

- What are the risks associated with investing in Tesla?

- Risks include regulatory changes, supply chain disruptions, increased competition, and market volatility. Investors should consider these factors when evaluating Tesla’s stock.

- What are Tesla’s future growth prospects?

- Tesla’s future growth prospects include expanding vehicle production, advancing battery technology, increasing global market presence, and growing its energy business. The company aims to produce 20 million vehicles annually by 2030 and continue innovating in sustainable energy.

-

Man wins $1 million scratch-off lottery ticket with $20 bill found on the ground

CNN —. When a North Carolina man headed to a convenience store on Tuesday, he had no idea luck was on his side.. Jerry Hicks, a master carpenter from Banner …

-

Dexcom Pares Steep Losses As Exec Plots Exit Amid Stelo Launch

The company continues to expect 11% to 13% organic sales growth this year.

-

ResMed Leans On GLP-1 Drugs, Big Tech For Sprint And Breakout

The company beat fiscal first-quarter expectations. Shares broke out of a flat base.

-

Shoemaker Runs Past Entry As Peer Sprints On Earnings

Deckers earnings beat on strong Hoka sales. DECK stock rallied above an early entry. Skechers climbs on results. Rival On Holding pops.

-

Gold prices have surged in 2024. Here’s how to get in on the gold rush

CNN —. Not all that glitters is gold, but the value of the precious metal has been surgingthis year.. Gold prices have broken record after record, rising more than 30% …

-

39-year-old makes about $18,000 a month in passive income without a college degree: ‘I work only 4 hours a day’

After dropping out of college in 2007, Amy Landino started a side hustle creating videos and doing social media. Ultimately she was able to quit her day job.