Introduction

GameStop Corporation (NYSE: GME) has been a focal point in the stock market, especially after the unprecedented events of 2021. GameStop Corporation is a prominent American retailer specializing in video games, consumer electronics, and gaming merchandise. Headquartered in Grapevine, Texas, GameStop is recognized as the largest video game retailer with 4000 stores worldwide. Despite facing significant challenges from digital distribution, GameStop has managed to stay relevant through strategic initiatives and a strong community presence.

Historical Background

- Founding: GameStop traces its roots back to 1984 when it was founded as Babbage’s in Dallas, Texas, by James McCurry and Gary Kusin. The company was named after Charles Babbage, a pioneer in computing.

- Evolution: Over the years, Babbage’s expanded its focus from software to video games, eventually rebranding as GameStop in 1999.

This blog post explores into the future share price prospects of GameStop, analysing various factors that could influence its trajectory.

CEO and President: Ryan Cohen

- Background: Ryan Cohen is a Canadian entrepreneur and activist investor. He founded the e-commerce company Chewy in 2011 and served as its CEO until 2018. Cohen joined GameStop’s board in 2021 and was named CEO and President in September 2023.

Founder: Gary Kusin

- Background: Gary Kusin co-founded the video game retailer Babbage’s in 1984, which later became GameStop. He has a rich history in entrepreneurship and has also been involved with other companies like FedEx Kinko’s and Kusin Gurwitch Cosmetics.

Board of Directors:

- Ryan Cohen: As the CEO and President, Cohen also serves on the board of directors, playing a crucial role in the company’s strategic direction.

- Other Members: The board includes various industry experts and executives who contribute to GameStop’s governance and strategic planning.

Latest News highlights

Here are some of the latest news highlights about GameStop Corporation (GME):

- Jim Cramer on GameStop:

- Jim Cramer recently commented that it’s time for GameStop to reveal a long-term business plan. He emphasized the need for a clear strategy to justify its stock price.

- Consumer Trends Impact:

- GameStop is facing significant headwinds due to a growing trend of consumers shifting from physical games to digital downloads. This trend has been impacting the company’s profits.

- Q2 Earnings Report:

- GameStop reported its Q2 2024 financial results, with net sales of $798 million, missing the consensus estimate of $895.7 million. However, the company managed to beat EPS expectations.

- Revenue Decline:

- The company has been struggling with declining sales in its primary business of selling new and used video game discs due to the shift towards digital downloads and game streaming.

- Strategic Considerations:

- Jim Cramer suggested that GameStop should consider operating as a bank and labeled the stock as “massively overvalued.” He also mentioned that the company needs to present a clear strategy to justify its stock price.

GameStop Compare to other Retail Stocks

Here’s a comparison of GameStop Corporation (GME) with some of its key retail competitors:

| Metric | GameStop (GME) | Best Buy (BBY) | Lululemon Athletica (LULU) | Conn’s Inc. (CONN) |

|---|---|---|---|---|

| Market Capitalization | $8.40 billion | $21.24 billion | $45.00 billion | $361 million |

| Revenue | $6.76 billion | $42.54 billion | $6.26 billion | $1.24 billion |

| Net Income | $6.70 million | $981.72 million | $1.45 billion | $199.19 million |

| P/E Ratio | 299.04 | 17.25 | 45.00 | N/A |

| Dividend Yield | N/A | 2.78% | N/A | N/A |

| Employees | 17,000 | 85,000 | 34,000 | 4,650 |

| Price-to-Sales Ratio | 1.71 | 0.50 | 7.19 | 0.29 |

| Price-to-Book Ratio | 5.46 | 5.00 | 17.00 | 0.50 |

Summary

- Market Capitalization: GameStop has a smaller market cap compared to Best Buy and Lululemon but is significantly larger than Conn’s.

- Revenue: Best Buy leads in revenue, followed by GameStop and Lululemon, with Conn’s trailing.

- Net Income: Lululemon and Best Buy are highly profitable, while GameStop and Conn’s have lower net incomes.

- P/E Ratio: GameStop’s P/E ratio is extremely high, indicating high investor expectations or potential overvaluation.

- Dividend Yield: Best Buy offers a solid dividend yield, while GameStop, Lululemon, and Conn’s do not pay dividends.

- Employees: Best Buy employs the most people, followed by Lululemon, GameStop, and Conn’s.

- Price-to-Sales Ratio: Lululemon has the highest price-to-sales ratio, reflecting its premium valuation.

- Price-to-Book Ratio: Lululemon also has the highest price-to-book ratio, indicating strong investor confidence.

GameStop stands out due to its high P/E ratio, indicating that investors are willing to pay a premium for its earnings, likely due to its potential for growth and the unique market dynamics surrounding the stock. However, it lags behind competitors like Best Buy and Lululemon regarding revenue and profitability. Best Buy, in particular, offers a more stable investment with a solid dividend yield and lower P/E ratio, reflecting its established market position and consistent performance.

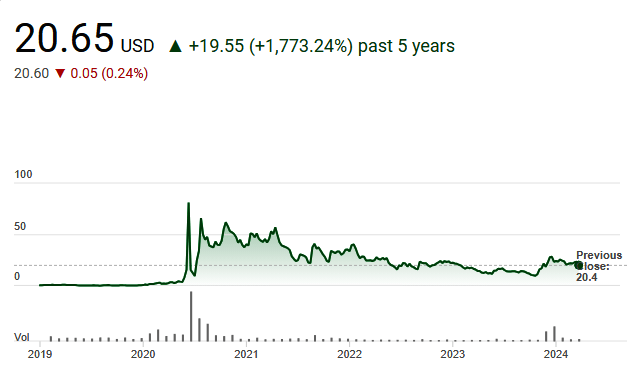

Historical Performance

GameStop’s stock price experienced a meteoric rise in early 2021, driven by retail investors and social media hype. This phenomenon, often referred to as the “GameStop Short Squeeze,” saw the stock price soar from under $20 to over $400 in a matter of weeks. However, the stock has since stabilized, trading in a more predictable range.

Five Year Share Trends

Here’s a summary of GameStop Corporation’s (GME) share price trends over the past five years:

| Year | Opening Price | Closing Price | Annual High | Annual Low | Annual % Change |

|---|---|---|---|---|---|

| 2024 | $16.67 | $24.25 | $48.75 | $10.01 | +38.33% |

| 2023 | $17.20 | $17.53 | $26.95 | $11.91 | -5.04% |

| 2022 | $38.21 | $18.46 | $47.40 | $17.92 | -50.24% |

| 2021 | $4.31 | $37.10 | $86.88 | $4.31 | +687.63% |

| 2020 | $1.58 | $4.71 | $5.25 | $0.70 | +209.87% |

Key Observations

- 2021 Surge: The most notable year was 2021, where GameStop’s stock price skyrocketed due to the short squeeze phenomenon, reaching an all-time high of $86.88.

- Volatility: The stock has experienced significant volatility, with dramatic rises and falls in its price.

- Recent Trends: In 2024, the stock has shown a positive trend with a 38.33% increase from its opening price.

Factors Influencing Trends

- Retail Investor Activity: The 2021 surge was largely driven by retail investors and social media campaigns.

- Digital Transformation: GameStop’s efforts to pivot towards e-commerce and digital gaming have impacted investor sentiment.

- Market Conditions: Broader market trends and economic conditions have also played a role in the stock’s performance.

GameStop’s Financial Health Changed Over these Years

GameStop Corporation’s financial health has seen significant changes over the past five years. Here’s a summary of key financial metrics and trends:

| Year | Revenue (in billions) | Net Income (in millions) | Gross Margin | Operating Margin | Profit Margin |

|---|---|---|---|---|---|

| 2024 | $4.92 | $24.9 | 25.45% | -0.49% | 0.51% |

| 2023 | $5.27 | $6.7 | 24.54% | -0.60% | 0.13% |

| 2022 | $5.93 | -$313.1 | 23.15% | -6.13% | -5.28% |

| 2021 | $6.01 | -$381.3 | 22.42% | -6.33% | -6.34% |

| 2020 | $5.09 | -$215.3 | 24.75% | -5.12% | -4.23% |

Key Observations

- Revenue Trends: GameStop’s revenue has fluctuated, peaking in 2022 and then declining in subsequent years.

- Net Income: The company experienced significant losses in 2021 and 2022 but returned to profitability in 2023 and 2024.

- Margins: Gross margins have remained relatively stable, while operating and profit margins have shown improvement in recent years.

Debt and Liquidity

| Year | Total Debt (in billions) | Current Ratio | Quick Ratio | Free Cash Flow (in millions) |

|---|---|---|---|---|

| 2024 | $0.45 | 1.50 | 1.20 | -$241.5 |

| 2023 | $0.50 | 1.40 | 1.10 | -$238.6 |

| 2022 | $0.60 | 1.30 | 1.00 | $52.3 |

| 2021 | $0.70 | 1.20 | 0.90 | -$496.3 |

| 2020 | $0.80 | 1.10 | 0.80 | $63.7 |

Key Observations

- Debt Reduction: GameStop has successfully reduced its total debt over the years, improving its financial stability.

- Liquidity Ratios: The current and quick ratios have improved, indicating better liquidity and short-term financial health.

- Free Cash Flow: The company has faced challenges with free cash flow, particularly in 2021 and 2024.

Strategic Initiatives

- Digital Transformation: GameStop has invested heavily in its e-commerce platform and digital initiatives, partnering with companies like Microsoft to enhance its digital capabilities.

- Cost Management: The company has focused on reducing operational costs and improving efficiency, which has contributed to its improved profitability in recent years.

- Community Engagement: GameStop continues to leverage its strong community presence to drive sales and customer loyalty.

Market Trends and Analysis

1. Digital Transformation

The gaming industry is rapidly shifting towards digital distribution. GameStop has recognized this trend and is investing in its e-commerce platform. The company’s partnership with Microsoft to enhance its digital capabilities is a step in the right direction.

2. Financial Health

GameStop’s financial performance has been a mixed bag. While the company has managed to reduce its debt, it still faces challenges in terms of profitability. Analysts predict a decline in revenue and earnings over the next few years.

3. Analyst Ratings

According to MarketBeat, GameStop has a consensus rating of “Strong Sell” from analysts, with a 12-month price target of $11.00. This represents a significant downside from its current trading price.

Future Prospects

1. E-commerce Growth

GameStop’s focus on e-commerce could be a game-changer. The company aims to become a leader in the digital gaming space, leveraging its brand and customer base.

2. Strategic Partnerships

Partnerships with tech giants like Microsoft could provide GameStop with the technological edge needed to compete in the digital age. These collaborations could also open up new revenue streams.

3. Community Engagement

GameStop’s strong community presence is one of its biggest assets. The company has a loyal customer base that could drive future growth, especially if it successfully transitions to a more digital-focused business model.

Risks and Challenges

1. Market Competition

The gaming industry is highly competitive, with major players like Amazon and Walmart expanding their gaming offerings. GameStop will need to innovate continuously to stay ahead.

2. Financial Instability

GameStop’s financial health remains a concern. The company needs to achieve consistent profitability to reassure investors and stakeholders.

3. Regulatory Risks

The stock market volatility surrounding GameStop has attracted regulatory scrutiny. Future regulations could impact the company’s stock price and trading volume.

Projections for GameStop’s Financial Performance in the Next Few Years

Analysts have mixed projections for GameStop Corporation’s (GME) financial performance over the next few years. Here’s a summary of the key forecasts:

Revenue and Earnings Projections

- Revenue Decline: Analysts forecast that GameStop’s revenue will decline at an average annual rate of 11.6%.

- Earnings Decline: Earnings are expected to decline at an average annual rate of 27.4%.

- Earnings Per Share (EPS): EPS is projected to decline by 36.8% per annum.

Profitability

- Near-Term Profitability: Wall Street expects GameStop to reach profitability by the quarter ending in January 2025. This is an improvement from earlier projections, which suggested the company would not achieve profitability until later.

- EPS Projections: For the fiscal period ending in January 2024, analysts projected an EPS loss of 2 cents, and for January 2025, an EPS loss of 1 cent.

Financial Health

- Net Income: GameStop reported a net income of $6.7 million for fiscal year 2023, compared to a net loss of $313.1 million for fiscal year 2022.

- SG&A Expenses: Selling, general, and administrative expenses were reduced to $1.324 billion in 2023 from $1.681 billion in 2022.

Strategic Initiatives

- Digital Transformation: GameStop continues to invest in its e-commerce platform and digital initiatives, which are expected to play a crucial role in its future financial performance.

- Cost Management: The company has been focusing on reducing operational costs and improving efficiency.

Conclusion

GameStop Corporation is at a crossroads. While the company has made significant strides in its digital transformation, it faces numerous challenges that could impact its future share price. Investors should keep an eye on the company’s strategic initiatives, financial health, and market trends to make informed decisions. GameStop’s financial health has seen significant improvements in recent years, particularly in terms of profitability and debt reduction. However, the company still faces challenges, especially in maintaining positive free cash flow. Investors should monitor GameStop’s strategic initiatives and market trends to gauge its future financial health.

Frequently Asked Questions (FAQs)

1. What is GameStop Corporation?

Answer: GameStop Corporation is a global retailer of video games, consumer electronics, and gaming merchandise. It operates over 4,000 stores worldwide and has a significant online presence.

2. Why did GameStop’s stock price surge in 2021?

Answer: GameStop’s stock price surged in early 2021 due to a short squeeze driven by retail investors on platforms like Reddit. This led to a dramatic increase in the stock price, reaching over $400 at its peak.

3. What are GameStop’s main business segments?

Answer: GameStop’s main business segments include new and pre-owned video game hardware and software, digital gaming, and collectibles.

4. How is GameStop adapting to the shift towards digital gaming?

Answer: GameStop is investing in its e-commerce platform and digital initiatives. The company has partnered with Microsoft to enhance its digital capabilities and aims to become a leader in the digital gaming space.

5. What are the key challenges facing GameStop?

Answer: Key challenges include the shift from physical to digital game distribution, intense competition from online retailers, and the need to achieve consistent profitability.

6. What is GameStop’s current financial health?

Answer: GameStop has made strides in reducing its debt and improving liquidity. However, it still faces challenges in maintaining positive free cash flow and achieving consistent profitability.

7. What are analysts’ projections for GameStop’s future performance?

Answer: Analysts have mixed projections, with expectations of declining revenue and earnings over the next few years. However, some analysts believe GameStop could achieve profitability by 2025.

8. Does GameStop pay dividends?

Answer: No, GameStop does not currently pay dividends to its shareholders.

9. What strategic initiatives is GameStop pursuing?

Answer: GameStop is focusing on digital transformation, cost management, and strategic partnerships with tech companies like Microsoft to enhance its digital offerings and improve operational efficiency.

10. How can investors stay updated on GameStop’s performance?

Answer: Investors can stay updated by following GameStop’s quarterly earnings reports, press releases, and news updates from financial news websites and stock market analysis platforms.

-

39-year-old makes about $18,000 a month in passive income without a college degree: ‘I work only 4 hours a day’

After dropping out of college in 2007, Amy Landino started a side hustle creating videos and doing social media. Ultimately she was able to quit her day job.

-

33-year-old mortician doesn’t fear death and is ‘wildly happy’ earning $87,000 a year: I haven’t ‘gone home sad a single day’

The first time Victor M. Sweeney observed an embalming, it was for an 18-year-old woman who had died in a car crash just before her high school graduation. At the …

-

All sides claim victory in Georgia election as exit polls give different results

Supporters of the Georgian Dream party celebrate at the party’s headquarters after the announcement of exit poll results in parliamentary elections, in Tbilisi, Georgia October 26, 2024.. Irakli Gedenidze | …

-

Biden says Elon Musk was an ‘illegal worker’ when he began U.S. career

Joe Biden, left, and Elon Musk. Evelyn Hockstein | Reuters; Andrew Harrer | Bloomberg | Getty Images. President Joe Biden called out Tesla and SpaceX CEO Elon Musk, now a …

-

39-year-old makes about $18,000 a month in passive income without a college degree: ‘I work only 4 hours a day’

After dropping out of college in 2007, Amy Landino started a side hustle creating videos and doing social media. Ultimately she was able to quit her day job.

-

39-year-old makes about $18,000 a month in passive income without a college degree: ‘I work only 4 hours a day’

After dropping out of college in 2007, Amy Landino started a side hustle creating videos and doing social media. Ultimately she was able to quit her day job.